In only eight days, 1.25 percentage points: This was the dramatic drop of the federal funds rate in January by the Federal Reserve Bank, the chief monetary policy making entity for the U.S., in response to worries of a possible recession. This drop of the key interest rate marks the largest one-month change in over a quarter of a century. At the same time, President Bush, along with Congress, passed the bill for an “economic stimulus package” giving many Americans a check in the mail (upwards of $300 – $600) to use at their discretion. Both of these expansionary fiscal and monetary policy maneuvers are designed to inject money into the economy in an attempt to increase aggregate demand and stave off the looming recession. If you are one for government intervention in the economy, this plan sounds fool-proof. Good-bye recession, right?

Wrong. There are many things that are slowing the American economy and cannot simply be solved by giving people more spending money. The housing crisis along with the credit crunch has hobbled many sectors of the economy, but chief among them are construction and more devastating to the economy: consumer spending.

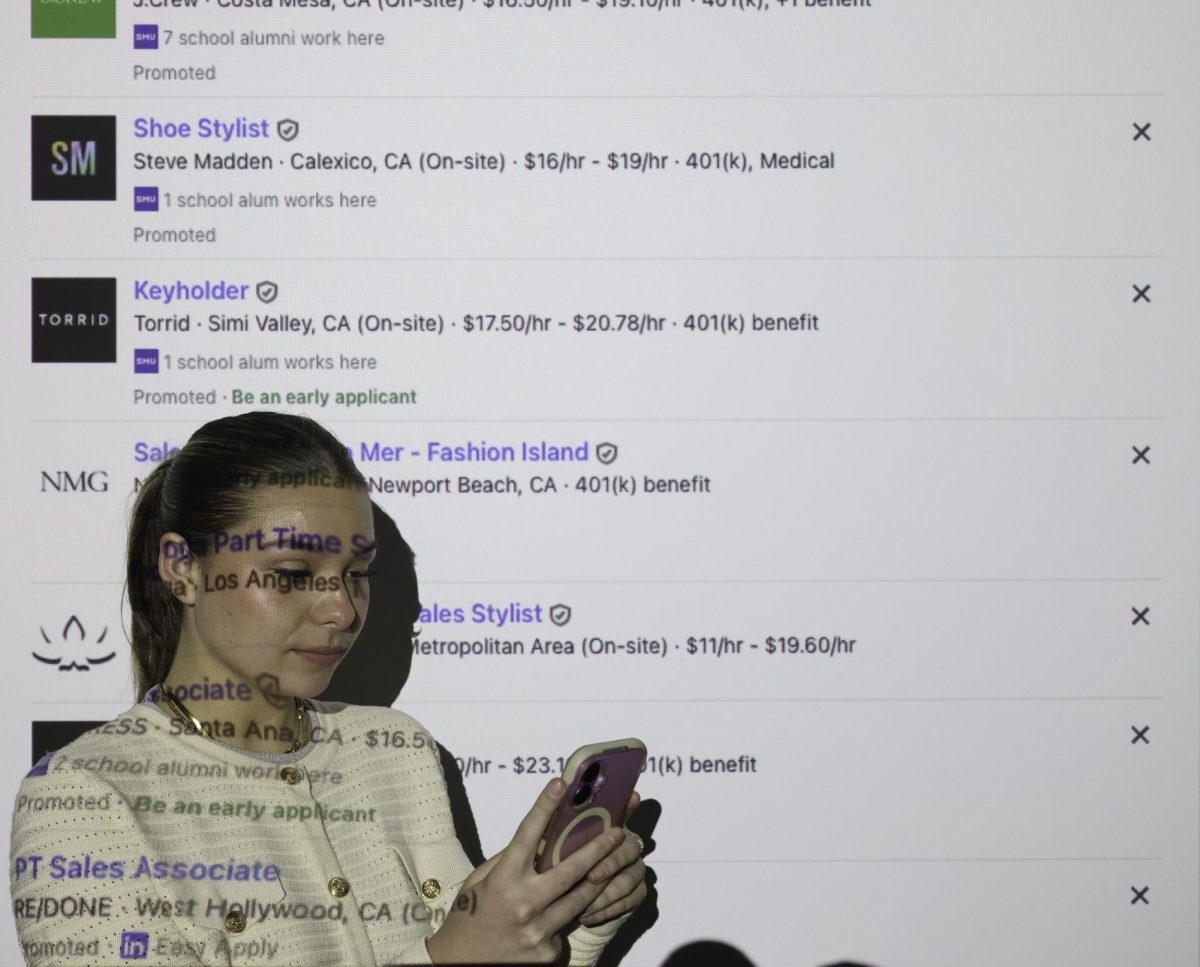

Many households now find themselves strapped for cash because of the hindering effects of the credit and equity crunches on consumer’s wallets. Any injection of money into the economy and into their pockets will likely result in spending to pay down debt, get caught up on mortgages or just saving during these times of economic turbulence. As a consumer, if you are behind on your mortgage or your debt level is creeping up and you are suddenly presented with cash from the government or the ability to borrow cheaper, you probably won’t be inclined to head out to J.Crew or the Sharper Image and spend that money away.

Another problem complicating matters is the price of oil. The price of crude light oil recently reached a historic level, topping $100 a barrel for the first time ever. High production input prices (oil) often spell trouble for an economy, especially one that has been ailing for at least one confirmed quarter. Higher production costs mean a reduction in aggregate supply in an economy because of the lower profit margin, with firms producing less come layoffs and higher unemployment, further contributing to the slowdown in the economy.

Higher energy prices also lead to another quandary: higher commodity prices. Producers are often forced to pass the higher input prices onto consumers in the form of higher prices in the checkout line. The Producer Price Index is often a leading indicator of inflation. The index showed a spike in PPI in both November and again in January, and will soon be released for the month of February.

It is because of these basic truths that recent Federal policy initiatives could land the American economy in stagflation waters. Such exuberant expansionary monetary policy in the face of the closest thing we have seen to an oil supply shock since 1973 could bring about ’70s-style stagnant growth coupled with rising price level, two situations that, when combined, form a policy-making nightmare. In the ’70s, both inflation and unemployment reached dangerously high levels at upwards of 10 percent in both. It is common that only one problem (inflation or unemployment) could be targeted at once because of the opposite nature of the correcting policies. An economic phenomenon like this is often sticky because of how policy is so hard to plan and is a situation that could devastate many American firms and households, not to mention integrated foreign markets.

The situation could worsen as oil prices continue to rise, and more rate cuts are expected when the Federal reserve board meets again on March 18. Federal Reserve Head Ben Bernanke and comapny need to be careful not to try and over stimulate the economy in the short run. Recessions are cyclical, and the American economy will flourish again with time. However, the economy is walking a very fine line and runaway stimulant policy could push it over the edge, giving American consumers and firms a blast from the economic past.

If Bernanke and crew are not careful, things could get a lot worse before they get better.

John Coleman is a junior majoring in economics. He can be reached for comment at jpcolema@smu.edu.