As one of the most popular amusement park attractions in the world, Six Flags Entertainment Corp. constantly impresses its customers with new, exciting rides and adventures. However, based on their most recent quarterly financial analysis, they may need to change a few things. The results prove just how much a simple calendar change and bad weather can negatively impact a company’s earnings.

Six Flags Entertainment suffered a 3% decrease in revenue in the most recent quarterly financial report, falling to $363,701 in 2013 after making $374,912 in the same quarterly results in 2012.

Why the change? A shift in the Easter holiday resulted in associated changes with school calendars, bringing attendance down by 4%. This calendar switch up, along with cooler temperatures and higher precipitation levels in the Eastern and Midwest parks, equaled loss for the company.

“Obviously, we would’ve preferred to deliver an even better Q2 performance. However, we had the timing impact of Easter/Spring Break attendance shifting into Q1 and we also experienced much cooler temperatures than average, a far higher precipitation in May and June than we had last year. I can definitely state that for both those parks, we saw the worst Q2 weather in over a decade,” said Jim Reid-Anderson, chairman, president and chief executive officer of Six Flags, in the quarterly conference call with investors.

Six Flags is the world’s largest amusement park corporation in terms of numbers of properties, and fifth most popular in terms of attendance. Their parks include water parks, theme parks, thrill rides, and family entertainment centers. The company headquarters is located in Grand Prairie, TX and the company entertains over 26 million guests every year in their locations across North America and Europe. As of Oct. 2, 2013, their stock was down 1.47% to $33.42.

“The stock looks very interesting from an investment point of view,” said Linda Hilaman, a financial consultant at Raymond James. “It is trading near its 52 week low, has a very attractive dividend yield of 5.44%, is trading with a low P/E ratio, has split 2 for 1 twice since the stocks inception, summer of 2010, trading below its 150 and 200 day moving average. This is the type of stock that should give both growth and income to the investor.”

Admissions revenue per capita increased $0.61 (3%) in 2013 compared to the quarterly financial results the year prior, due to increased pricing, reduced discounts and strong sales of a new premium priced gold season pass.

After the fatal accident at Six Flags Over Texas where a woman fell to her death this summer, Six Flags assured the public after the accident that they would do whatever they could to prevent this from happening again and to ensure that their customers felt safe. Therefore, it is no surprise that the company has dedicated $1.5 million towards park repair and maintenance spending. However, operating expenses still came down by 5% due to decreases in salaries, wages, and benefits.

“Any company would always prefer higher revenue and lower expenses. I believe our business performed well in the second quarter,” said Nancy Krejsa, senior vice president of investor relations and corporate communications at Six Flags.

Selling, general, and administrative expenses decreased a whopping 20% in the most recent quarter, reflecting decreases in salaries, wages, and benefits related to stock compensation. Due to the reduction in attendance at the parks, there was also reduced advertising expenses adding to this 20% decrease.

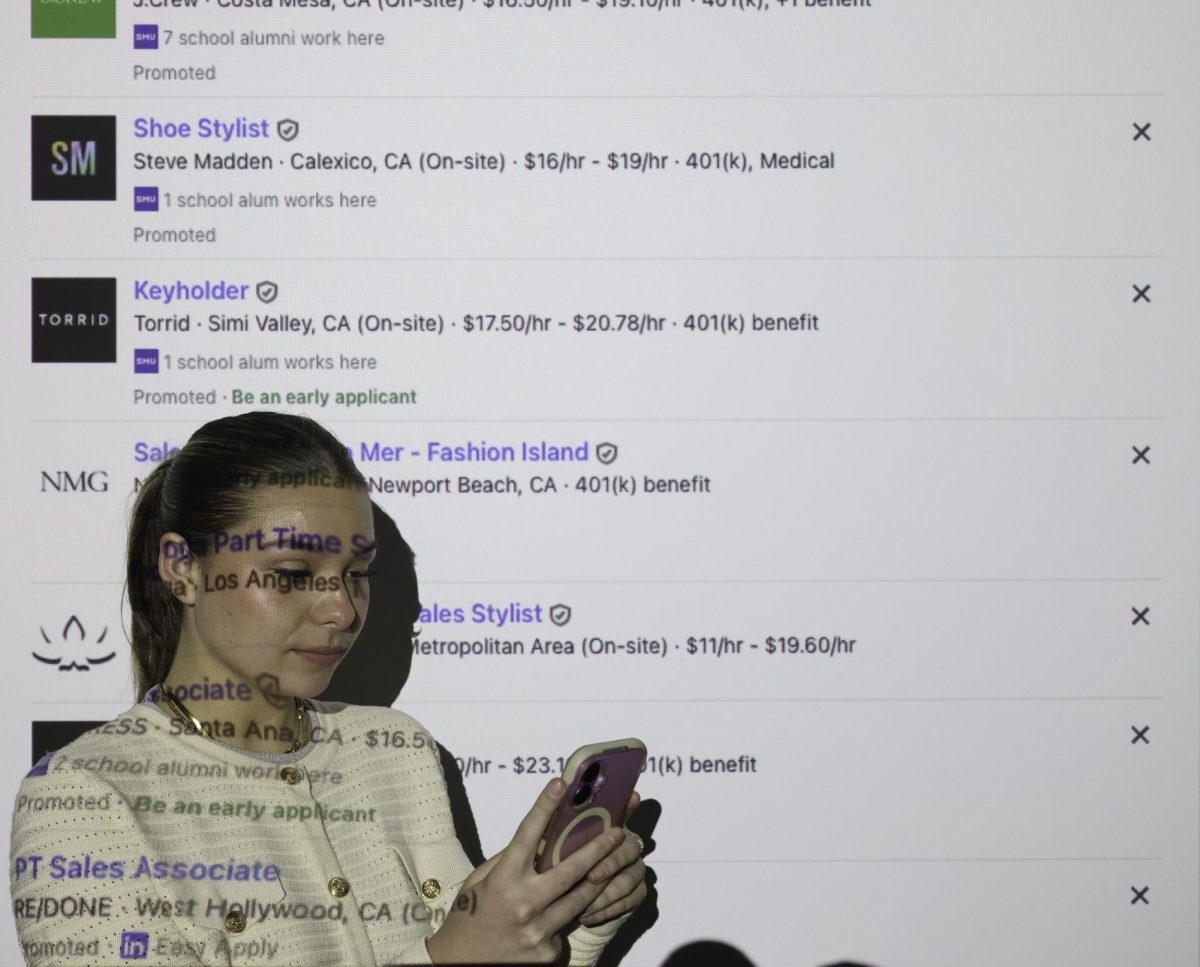

“One potential concern in looking at Six Flags operations is the choice to reduce advertising when revenues are declining. This step does reduce expenses, but the potential impact on future revenues is a concern,” said Greg Sommers, professor of practice at SMU’s Cox School of Business.

Six Flags saw a 4% increase in cost of products sold, due to increased costs associated with their assumption of operations for most in-park concessions, that previously had been operated by third parties.

The company is still in hopes to achieve its aspirational target of $500 million of modified EBITDA, approximately $3 per share of cash EPS, by 2015.