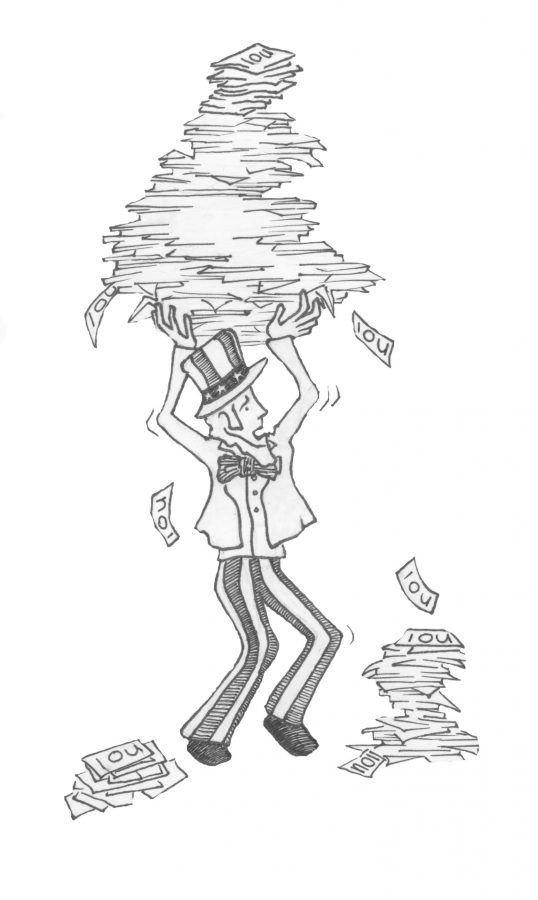

Graphic by CHLOE SABA/ The Daily Campus

Most students graduating from college have a plan, or at least a dream. A dream of where they want to end up, what they want to do or what kind of life they want to live. While dreaming of their future lifestyle and incorporating minute details, students often ignore one glaring fact that could tarnish that dream.

While thinking about life 10 years down the road, students often have a salary figure in mind that can help them achieve that goal. What many students don’t realize is how that figure could potentially need to be a lot higher due to events that are taking place today.

President Obama is currently fighting political battles on many fronts. Earlier in the year he pushed through a massive $787 billion stimulus package to help jump-start a tanking economy. His largest push is the historic health care reform, where he favors a public option of health care financed through public debt. He also currently has his hands full with a growing concern in Afghanistan. The commander of U.S. forces in Afghanistan recently said more troops would be needed to “win” the war. All this translates into dollar signs, and the U.S. is racking up the debt to be paid later.

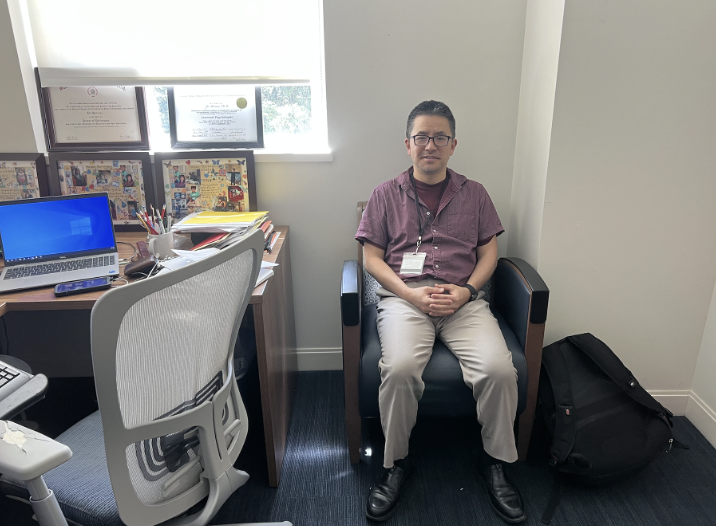

According to SMU professor Nathan Balke, there is a chance that all the spending the U.S. is doing now will be paid by the college-age generation’s paychecks in the form of higher taxes.

“There are a few ways for you to reduce the debt and correct a budget deficit,” Balke said. “One of those ways is simply to increase taxes, and that would have to be on future generations.”

According to Balke, the national debt is not the highest it has ever been relative to the country’s economic output. Instead, the concern is the large spike seen in the last decade, and the apparent increasing trajectory the debt level appears to be on.

He said that the combination of the George W. Bush tax cuts early on in the decade, the financial bailout packages at the tail end of the Bush presidency, along with President Obama’s current spending spree, has caused the national debt to leap out of its declining state.

The debt to economic output ratio was higher following the end of World War II, but the budget deficit was easily cut by cutting military spending, something not easily done today, Balke said.

A good way to think about it is as inter-generational borrowing, he said. Essentially, the current generation running the nation is borrowing money from future generations to pay for current expenditures. The only problem is that means fewer resources for future generations to work with.

According to Balke, there are essentially two ways out of a ballooning national debt and sky rocketing budget deficits: grow or tax.

Either way increases the tax base by creating more taxable income with a growing economy, or by increasing the tax level on current taxes incomes. Balke said the problem could easily be solved if the U.S. economy returned to robust form, but prolonged weakened growth could eventually lead to higher taxes to pay down the debt.

Debt is not necessarily a bad thing, Balk said.

“Sometimes you need to make expenditures now, and doing that with debt can be a good thing,” he said. “It can be nice if you are fighting a war, or have to stimulate the economy short term.”

Balke said what current policy is doing is essentially delaying the time taxes are collected and shifting them to the future. Whether this is a large burden on future generations is unclear and up for debate.

There are many pessimists that feel the debt will be a large hindrance to the current and younger generations. Super investor Warren Buffet warned that the U.S. is in peril of “being crushed under a mountain of debt.”

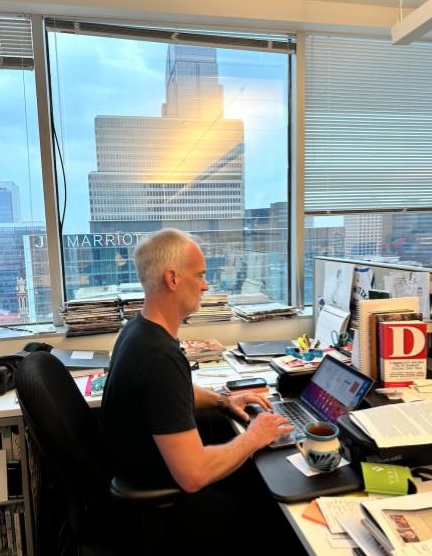

Thomas Friedman, columnist for The New York Times, recently compared the atom bomb, the greatest fear of his generation, to the current debt level, saying the youth generation will “live in fear of the great debt bomb.”

Balke, however, offered a rosier outlook.

“I think for the youth, that is really a second order concern for them,” Balke said. “They need to worry about building their human capital. Their skills and education – that is what they need to worry the most about for their future to be bright.”