Retail and food services sales, for October 2012 are down from last month but up from the same time last year. The U.S. Census Bureau announced on Nov. 14 that estimates of U.S. retail and food services sales for October were $411.6 billion, a decrease of 0.3 percent from September, but a 3.8 percent increase above October 2011. The year-over-year upswing in sales may be a small sign of economic recovery, especially since the increase in the later months is closer to the holidays. However, it is still too early to tell if this increase will last through the next two months.

The bureau also released the revised figure for the August to September 2012 percent change. Now at 1.3 percent, instead of the initially estimated 1.1 percent, the September number is better than what was originally reported. Excluding auto sales, the retail industry sales in October were flat at $336.8 billion, an important figure to include since the auto industry’s sales can easily fluctuate. The sales number excluding autos is still up 3.6 percent from last year. Gasoline stations’ sales have gone up a significant 7.7 percent from October 2011 and non-store retailers were up 7.2 percent from last year.

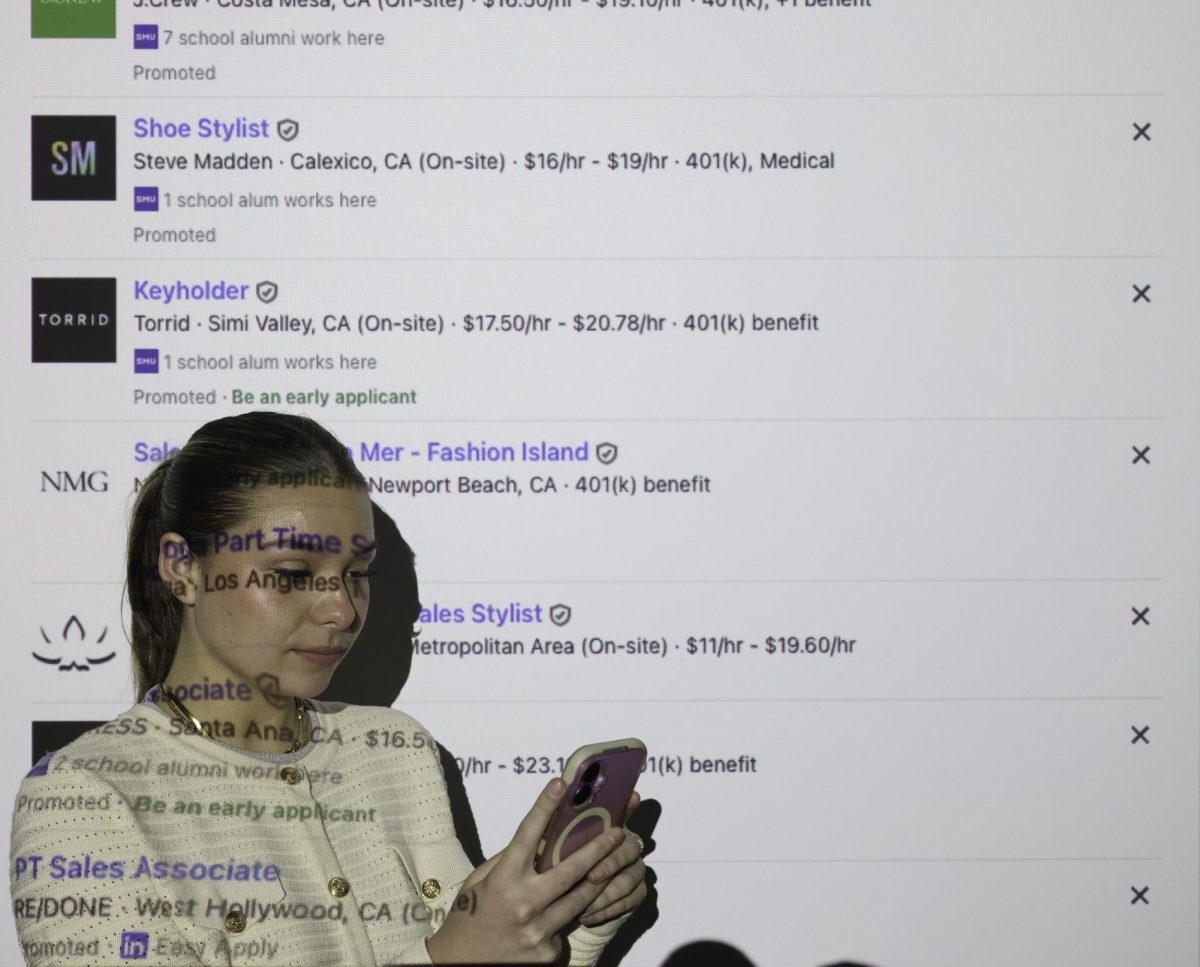

Tom Fomby, a professor at Southern Methodist University with a Ph.D. in economics, offered some insight into how to look at this month’s sales numbers.

“You have to verify that forward looking numbers vary, before revision there’s a guessed estimate,” Fomby said. “Year-over-year numbers account for seasonality.”

Fomby also noted that the upward change in gas sales might be related to more traveling that’s going on, a sign of a better economy.

Since the retail market is a driving force in the economy, these numbers will be carefully scrutinized over the next few months. With the economy still wobbly, though, consumers seem to be paying close attention to prices, and retailers are taking notice.

“I’m not the one to ask, but at the stores I go to, the prices don’t seem as expensive as last year,” said Matt Ballard, a nineteen-year-old shopper.

As a coveter of sneakers, Ballard frequently finds himself in stores such as Foot Locker, Champ’s, and Urban Outfitters.

“It depends on the store, obviously, and I don’t shop a lot, but it’s like whenever I’m at the mall there’s a new sale,” Ballard said. “I literally just bought some Nikes that just came out and I don’t think I could’ve done the same last year.”

Rico Hernandez has been working at the retail store Urban Outfitters for nearly four years, but says it’s been hard to tell if there’s been a tangible difference in business flow.

“More people are definitely out trying to find deals, more than previous years,” Hernandez said. “So that’s the new thing for us, we’re trying to get customers to come in and we’ve been tracking them with promotions, sales, stuff like that.”

Hernandez, manager of the Urban at Mockingbird Station, noted that an individual store’s performance has a lot to do with location, so while his store might be doing well, or poorly other locations might not be experiencing the same thing at the same time.

“With our location it fluctuates, so it’s different at the street level than it is at a location like the [Urban Outfitters] at NorthPark.

If there’s one thing Hernandez could say definitively, it was that compared to four years ago when he first started working, business has been noticeably better.