A young, married couple decides to buy a new house. As they sit down to do the paperwork, they quickly realize that the cost to cover their real estate investment is more than they anticipated.

Insurance premiums are more expensive than ever before, and there is a lack of something called terrorism insurance.

Despite the happenings of Sept. 11th, no one seems to know about that type of insurance. The couple decides to stay safe and wait until they are fully secure about their decision. Another potential transaction is lost.

President Bush signed the Terrorism Risk Insurance Act on November 26, 2002. The goal of the act is to make terrorism insurance more accessible and affordable for consumers, to stabilize the economy, and to secure more jobs.

The act will more effectively secure billions of dollars in investments. It also provides compensation for insured losses resulting from acts of terrorism so that American consumers are able to have coverage for future terrorism.

A 2002 press release from the Insurance Information Institute said that the 9/11 attacks cost the insurance industry $40.2 billion.

According to a Washington Times article, President Bush said he supports the terrorism act because he sees it as helping our economy grow.

According to an article from the Naples Daily News, Democrats feel government should pay a portion of damages including punitive damages but Republicans feel this will make “a no-holds-barred run on the U.S. Treasury” with people accusing each other with less than real reasons to acquire some money.

A concern for most Americans is the cost of terrorism insurance after Sept. 11th.

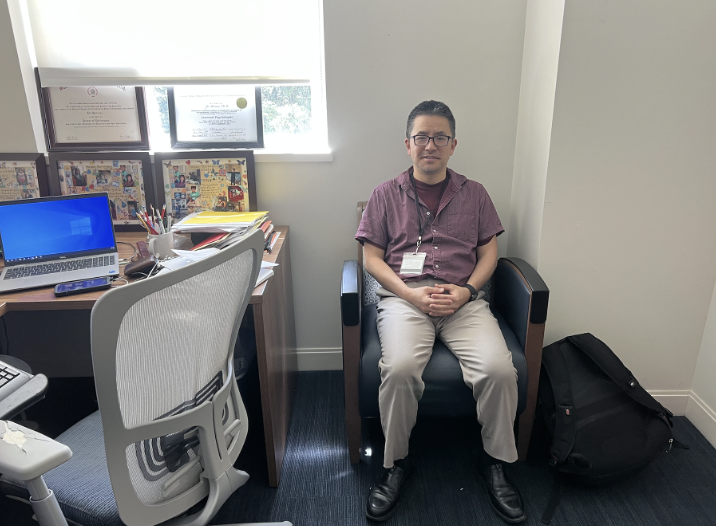

“Our insurance policy does provide liability coverage but not property coverage,” SMU director of risk management Anita Hopkins said.

She said that before Sept. 11th, terrorism insurance was generally included with property insurance. Now soaring premiums make it almost impossible for minimal coverage.

“[SMU] had one billion in property coverage last year,” Hopkins said. She said that now we hardly have enough to cover one building.

According to an article in the Washington Post, the insurers for George Washington University cut the school’s property insurance in half and raised the premium by 160 percent because renewal of terrorism insurance would cost 15 times more.

Another major problem is figuring out whether injured parties can sue for punitive damages as well as compensatory damages. Punitive damages encompass extra compensation to the plaintiff to punish the defendant for a serious wrong.

An obstacle for insurance companies is finding protection for themselves.

“There’s a misunderstanding [that] this is about the insurance industry,” P.J. Crowley, vice president for the Insurance Information Institute in New York, said in a Seattle Times article. “It’s really about the economy.”

Most financial responsibility falls on re-insurers, the insurers for insurance companies. This takes away the possibility that insurance companies’ goals are out to make some money since they also suffer loss of coverage.

These conditions are hazardous for the American economy as well are insurance agencies.