Senior Alexa Daniel is excited to enjoy the luxuries of living at home again after graduation so she has someone to do her laundry and provide her with meals. While she just landed her dream job with William Morris Endeavor in Beverly Hills, Calif., she is planning to live at home to save money before living independently.

“To save money and to live with my dog, of course,” said Daniel about her reasoning to live with her family after graduation.

“My mom is excited for me to come home, she just doesn’t like that I am a messy girl,” said Daniel.

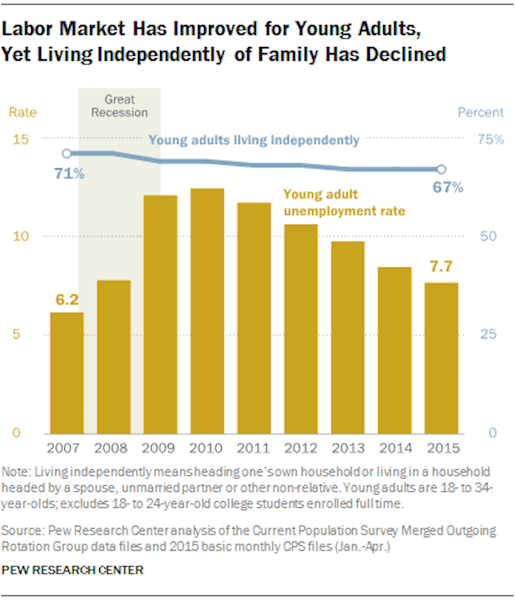

While the labor market is improving for recent grads, studies show that 18-year-olds to 34-year-olds are less likely to be living on their own today than during the Great Recession.

The population of young adults between the ages of 18 and 34 has grown by three million since 2007, according to a 2015 Pew Research Center report. The percentage of young adults living with their parents has increased from 24 to 26 percent since 2007.

Dr. Brian Fennig, a wellness professor at SMU, is not surprised by the Pew Research Center’s report from 2015.

“While SMU does a wonderful job setting people up, sometimes it takes time to get into your first real gig,” said Fennig.

According to research, the trends are not being steered by the job market. While the number of recent grads with full-time employment is increasing, the number of recent grads living independently is decreasing. Recent grads may have jobs lined up after graduation, but they are still choosing to live at home to save money.

It is still apparent, according to Pew Research Center, that college-educated millennials remain more likely to live independently than millennials who did not attend college.

While Fennig believes the choice to live at home varies based on different situations, he thinks some graduates may not have jobs, not have large enough entry salaries, not have enough savings to live on their own, or may just be a homebodies and not mature enough to leave home.

Regina James, the associate director of SMU’s Hegi Family Career Development Center, has only worked with one student who is planning to live at home after graduation. This student has a job lined up and will be making enough money to live independently, yet she is choosing to live at home for cultural reasons.

“She could have comfortably lived on her own with her salary, but decided to live at home with her family until she was ready to start her own family,” said James.

The same Pew Research Center report notes student loan debt and difficulties paying off debt as main reasons for living at home after graduation.

Some SMU graduates say they are not prepared to take on the real world independently just yet.

In the same situation as Daniel, Emily Faerber, also a senior, has a job lined up after graduation. She is working as an interior designer for Konstant Architecture and Planning in Chicago, but is planning to live at home for three months until she can save money to move downtown.

“I’m a very independent person, so I’m actually excited to eventually live on my own,” said Faerber.

Faerber tried to budget while she was a student, but wouldn’t say she necessarily saved up for her next step after graduation. She doesn’t mind being with her family and is looking forward to moving downtown after saving money.

Fennig said he also found himself living at home with his family after completing his first master’s degree. He did not find a job immediately and decided to live at home for six months while searching for jobs and attending job fairs.

Fennig encourages students to start saving early. He teaches students about budgeting and saving in his Personal Responsibility and Wellness 1 course. He covers credit, debt, and savings. His students get the biggest ‘aha’ moment when he asks them to bring a full month’s billing statement from either their credit cards or debit cards.

“The biggest thing is awareness,” Fennig said. “When students become aware, they start to realize what they are spending.”

“I have been budgeting, but definitely not saving,” said Daniel about budgeting and saving during college.

Some graduates have to live at home because of their lack of preparation for the real world. Fennig said he reminds students that they have to put everything it takes to live into the equation: where they are going to live, income they are receiving, phone bills, cable and internet bills, food costs, gas costs, and car payments.

“It’s called a budget, and if you don’t have one and you are going to live on your own, you are going to figure it out quickly,” said Fennig.

“The biggest challenge is going to be that I will not be able to splurge as much as I usually do, due to my low funds,” said Daniel about the difficulties of living independently.