Seated in a small coffee shop near campus, senior Ramah Jaradat discussed her future. She said she was raised by a kidney doctor and a stay-at-home mom in the affluent Dallas suburb of Southlake. Because her parents can help her financially, she doesn’t plan on becoming independent yet. Instead, she’ll head to law school after graduating in May with a business degree.

“I don’t pay for my loans. My dad pays for my full tuition. I also plan to go to law school, so I will not be working and depending on my parents,” Jaradat said.

Jaradat said she would wait until after law school to make any other life decisions.

“I would be fine with getting married after law school, but I would not want any children until I’m about 30 and have already established my career,” Jaradat said.

Jaradat is a good example of what researchers say is a trend among her generation: postponing the traditional markers of adulthood, including taking full responsibility for financial decisions and settling down in a full-time job or maybe even getting married.

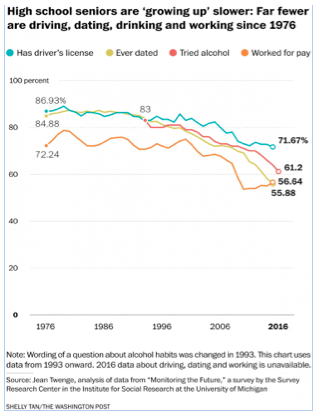

Instead, Jaradat and her cohorts are relying on parents for financial help while they go to graduate school or postponing student loan payments until after they start their career. According to a 2017 study on the decline of adult activities by San Diego State University professor Jean M. Twenge, high school seniors between 1976 to 1979 who had ever earned money dropped from 76 percent to 55 percent between 2010 and 2015.

Some students say dependence on parents allows room for creative exploration and gives them time to form better social and emotional connections. Others say taking too long to grow up can lead to fear-based decisions and higher anxiety levels.

Your Richest Life financial advisor Katie Brewer said many students don’t worry about loans until they graduate. Millennials assume they do not have to deal with accumulated costs until they realize they owe thousands of dollars.

“I have seen young people hesitate on getting married because they assume their loans will bring the other person down,” Brewer said.

Pushing off responsibilities including paying off loans leads to cohabiting, postponing a home purchase or burdening someone with debt. This forces millennials to remain dependent on their parents.

“People listen to the people they trust. Millennials trust their parents,” Brewer said.

The number of times teenagers go out to a movie or dinner without a parent has declined drastically since 1976. In college, kids usually start depending on peers rather than their parents for social support. However, many college students today are still emotionally or financially dependent on their parents.

Parents also nurture their children much more now. Saad Chehabi, parent of SMU student Lana Chehabi, admitted he would rather have his children stay at home and get their life together before jumping into the real world.

“I support my kids financially and don’t think it makes it difficult for them to handle responsibility,” Chehabi said.

Chehabi paid full tuition for three children to attend private high schools and their college tuitions. He understands the difficulty of paying off loans and wants his children to focus on their studies instead of debt.

Trevor Thomas, who just graduated in last May, admitted his student loans make financially supporting himself more difficult. He lived in Dallas his whole life and now resides in New York City as a financial analyst.

“Leaving my family after living near them my whole life made it difficult to adjust, especially with the hours I’m working,” Thomas said.

Families are having fewer children than in prior years so they can provide more resources to their children. National Vital Statistics reported the fertility rate declined from 1990 through 2014.

“This allows parents to focus on children,” junior Jesse Boal said. “My parents were very supportive of me doing hobbies. I was in football, wrestling and cross-country.”

Boal only has one older sister, and the siblings can both enjoy multiple activities. Like Jaradat, Boal doesn’t plan on settling down post-graduation.

“I don’t think I’ll be able to technically settle right after college because I’m planning on going to graduate school,” Boal said.