Americans across the country are experiencing blows to their pockets leaving them to deeply reconsider their lifestyles. For most, the nation’s current economic issues have undoubtedly become factored into their lives and an education is at the bottom of their list of priorities. Their university preference or number one choice is simply too costly, leaving them to weigh out the options and the alternatives they can choose from.

It is no secret that unemployment rates are at an all time high of 10 percent and the direct effect of the unemployed in America is causing a scare in the college and university world. The New York Times reported that admissions officers nationwide are pointing to several possible reasons for the 30 percent drop in applications; one is the fact that many students and parents are looking into less-expensive state universities and the other possibility is that some experts believe students are postponing their college plans. In fact, both possibilities hold true for recent high school graduate Matthew Rodriquez.

Rodriguez graduated from high school in May 2009 and is currently working in the shipping and receiving department at UPS to save money for his college education, which he is expecting to begin in the fall of 2010, and to help relieve his mother’s financial burdens. Rodriguez, like so many of his other high school friends, has set his sights on North Lake Community College, part of the Dallas County Community College District, where he would be able to pay tuition costs that are within his budget.

Rodriguez said, “It really comes down to the cost. I can take a three-credit-hour course for $123 versus what, nearly $32,000 a year at a private university. I’ve done the research andI know my family’s budget and my mom and I put together couldn’t afford that right now plus I know I would like to stay away from loans as long as I can.” Community colleges offer students seeking higher education an opportunity to gain a two-year course credit that is transferable to many state and private universities with generous transfer scholarships and incentives.

Selecting an institution for higher education during a recession is difficult for many students and parents alike; however, student services offered and the cost seem to be the clashing and defining issues. Reuters reported that private universities have equipped themselves with a Web-based tool, EducationDynamics, to resist a decline in enrollment during the recession and to convey the cost and qualities of private institutions versus the public competition to parents. EducationDynamics’ number two value suggestion that categorizes most with parents is the student services factor of a private institution, which does not rely on state support like public colleges who tend to increase tuition for a lack of support, rather private institutions tend to re-invest dollars to increase educational quality.

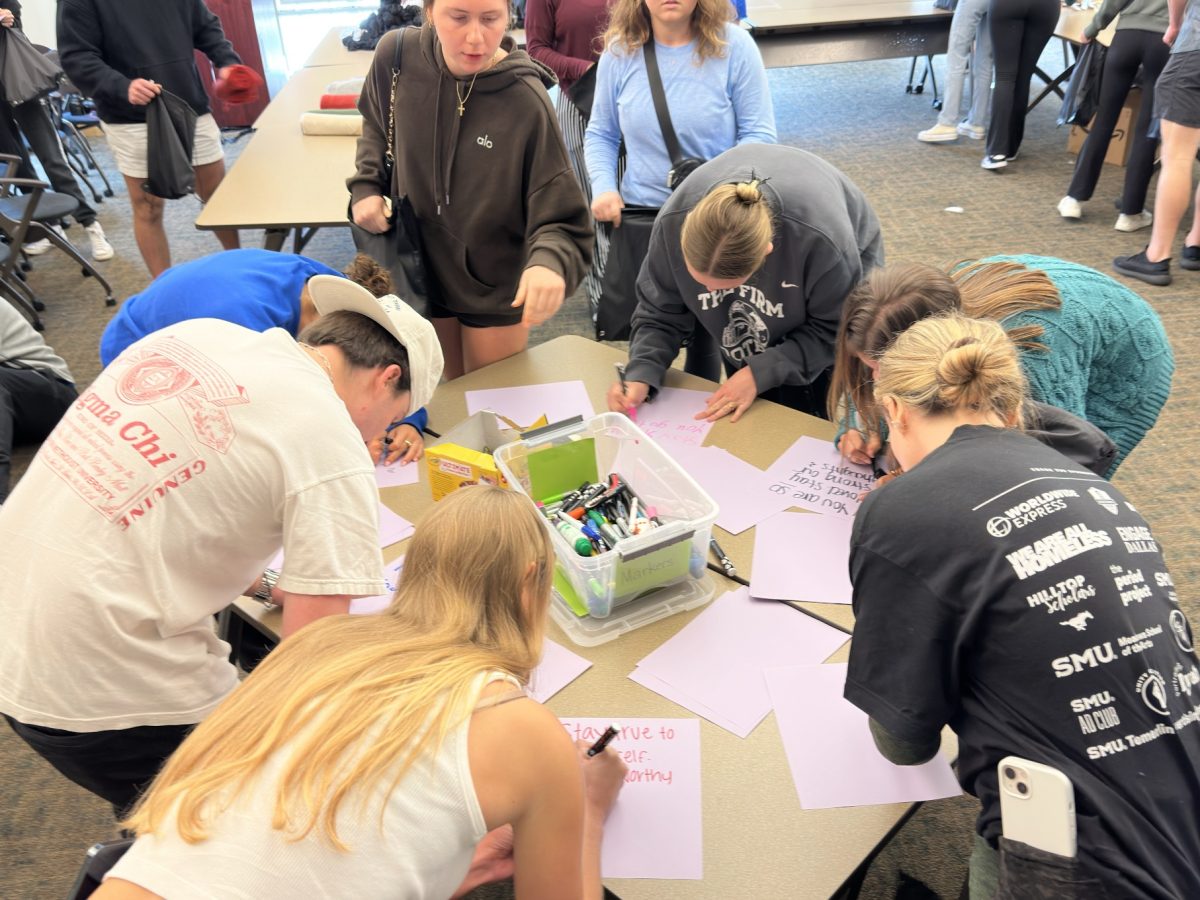

Sarah Bray, like many students around the nation and on her very own campus, is struggling financially with an unemployed single parent. Yet she and her mother identify with EducationDynamics’ number two proposal “I looked into transferring, but can’t bear the thought of leaving my friends. I love SMU and my mom knows how important my education is,” Bray said.

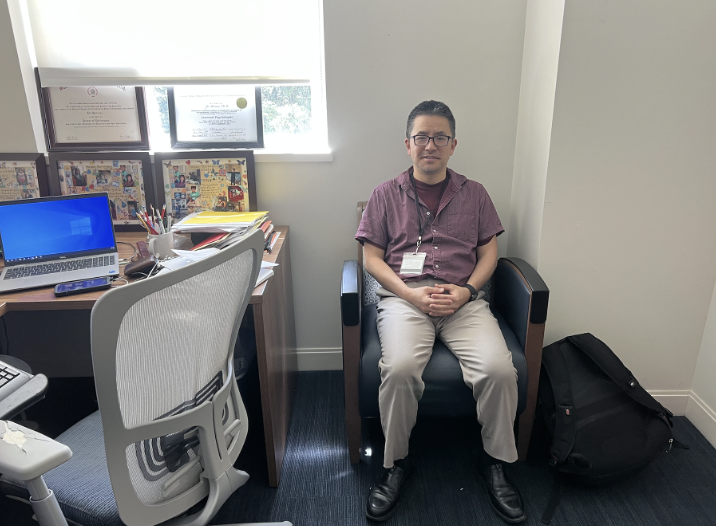

Kerry Schneidewind, an SMU admission counselor said, “We definitely let students know that you get what you pay for. An education at SMU will provide a solid background and the education necessary to be successful in the future. Along with the academic rigor and student experience, SMU is a great bargain.”

Bray has a long list of student activities on and off campus that are expected to increase the quality of her education and resume. “I am taking 16 hours, hold a position in my sorority, I am an Associate Arts & Entertainment Editor for The Daily Campus, Vice President of an SMU on-campus club (SMU Retail Club, through Cox School of Business), and I am active in several Dallas community organizations,” said Bray.

Reuters report on EducationDynamics listed the number one appeal to parents as getting them to look beyond the “school’s sticker price” and instead focus on a private institution’s substantial discounts in the form of need and merit-based scholarships. In fact, NYTimes.com reported that Ivy League universities have as many applicants as ever and even more applying for financial aid due to the generous aid packages they to low and middle income families.

Schneidewind said, “We are noticing that students are maximizing their options as far as scholarships and financial aid goes and will generally pick a college that will be an academic and financial fit for them and their family. Around 75 percent of our students receive some form of scholarships and/or financial aid.”

Misconceptions run rampant when it comes to the cost of a quality educati

on; this is especially true in a recession. However, parents and students are now equipped with better tools for learning in a recession.