A Texas bill seeks to eliminate sales tax from textbook purchases to alleviate extra costs for college students.

The bill would designate seven consecutive days at the beginning of January and August for the exemption. Students would present valid school ID cards to establish status as a full-or-part-time student.

For students on the pre-med or pre-law track, textbooks can cost several hundred dollars. Tricia Tsang, a junior on the pre-med track, normally spends up to $300 on textbooks each semester.

“It would definitely help me and probably other students who are in a similar position as me, low-income, first-generation students, to actually succeed and reach their career goals,” Tsang said.

Members of the house and senate have introduced bills with similar goals since 2009, none of which have become law. In this legislative session, Representative Terry Canales and Senator Sarah Eckhardt launched a companion bill to expedite the process.

“SB 278 is a major part of creating opportunity infrastructure that eases people’s lives and builds access to a better future for all Texans,” Senator Eckhardt said in a statement.

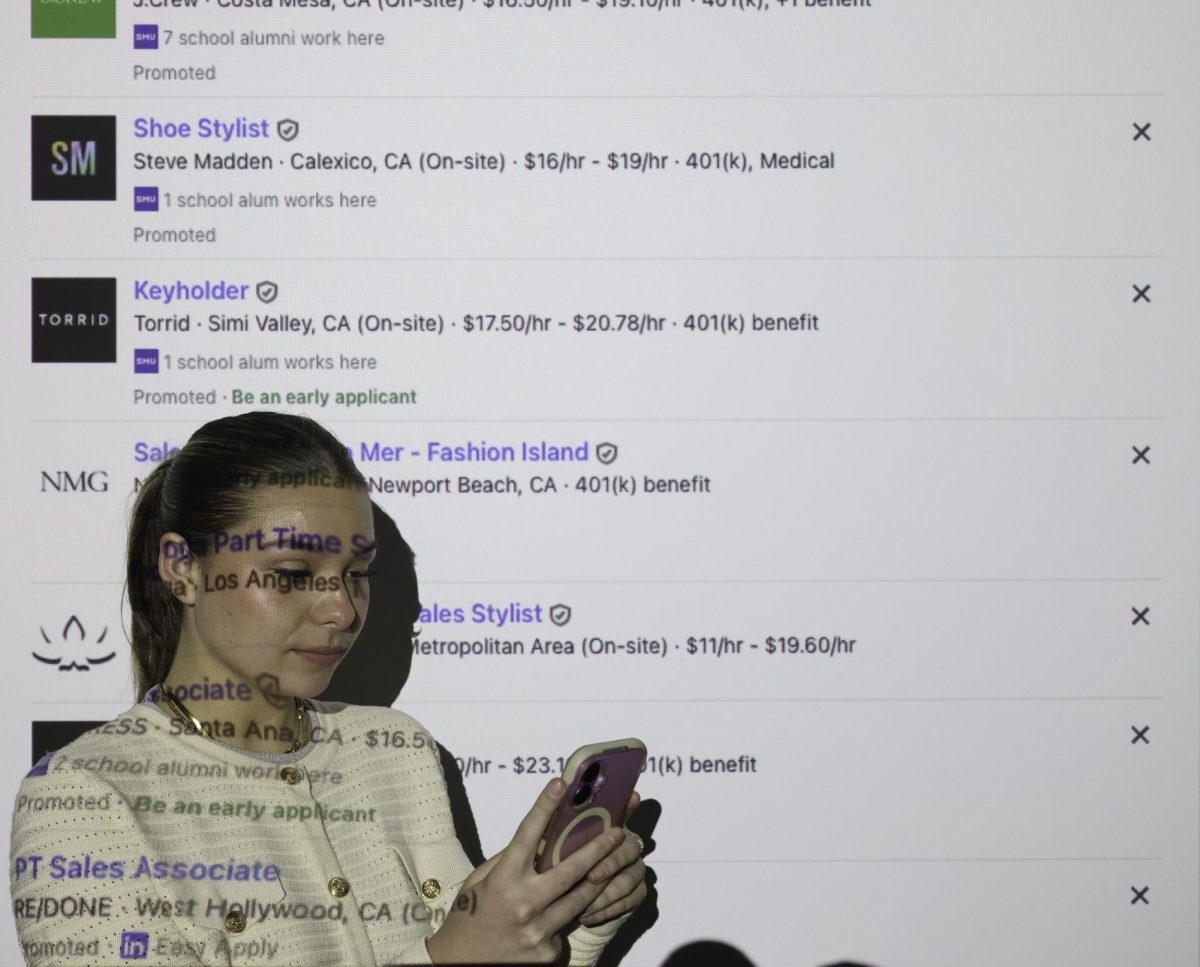

If the bill were passed, however, some students don’t think it would be helpful. Lillian Duma, a pre-law student at SMU, finds the bill minimally beneficial.

“I think it’s like a band aid to a bigger problem,” Duma said. “College is super expensive, and I think that they are finally acknowledging that but making textbooks tax-free isn’t going to make college affordable.”

According to the Bureau of Labor Statistics, textbook prices have increased by 88 percent in the past 10 years. Senator Eckhardt says the average cost of textbooks ranges from $105 to $400. She has high hopes that the bill will pass and that students will be able to take advantage of this tax exemption come the start of the coming fall and spring semesters.

“This bill’s exemption period hopes to alleviate some of that burden in the immediate while we develop other solutions to work in tandem at curbing the cost of higher education and improving access,” Senator Eckhardt said.

As students wait for the bill to pass, they hope to catch a glimpse of how much money it can save them.

“If I was to consider all the taxes like that I’ve had to spend on my [textbooks], I’d probably save a good chunk of money, at least towards paying for my cost of attendance or for [textbooks] or other reading materials that I need for the next school year,” Tsang said.