South Dallas’s Intermodal Hub located along Interstates 20 and 45. (Uprr.com)

Texas has long been an ideal place to start and grow a business. Promising job growth, no state income tax and few business regulations make it an attractive place to out-of-towners.

While the migration to Texas has been underway for several years, there’s a new trend in an area of Dallas that has struggled in the past. Major businesses are moving to South Dallas, and Dallas Mayor Mike Rawlings is happy to see it.

“Growing Southern Dallas is important to the future vitality of our city, and I believe that any company looking to relocate to North Texas will see the value in Southern Dallas,” he wrote in an e-mail about his economic development program “GrowSouth,” which launched in February 2012.

The plan provides economic incentives for major businesses to build in South Dallas’s Intermodal Hub along Interstates 20 and 45. Often regarded as the “Inland Port,” the hub connects Texas to the 40 percent of U.S. imports from Los Angeles and Long Beach in California.

Last fall, the city approved nearly $4.5 million worth of tax abatements and economic development grants for the construction of a L’Oreal distribution center in the Inland Port.

Within a month, L’Oreal, the world’s largest cosmetic, beauty and hair-care company, broke ground on a $17 million 513,000-square-foot facility. The Center is expected to create an estimated 75 jobs and ease distribution from a nearby factory in Mexico.

Other major companies building in south Dallas are PepsiCo, Ace Hardware, Quaker Oats and BMW.

“It is really exciting to see so many business opportunities and companies exploring their options of relocating to our city,” said Rawlings, whose efforts for growing south Dallas also include the creation of a private investment fund.

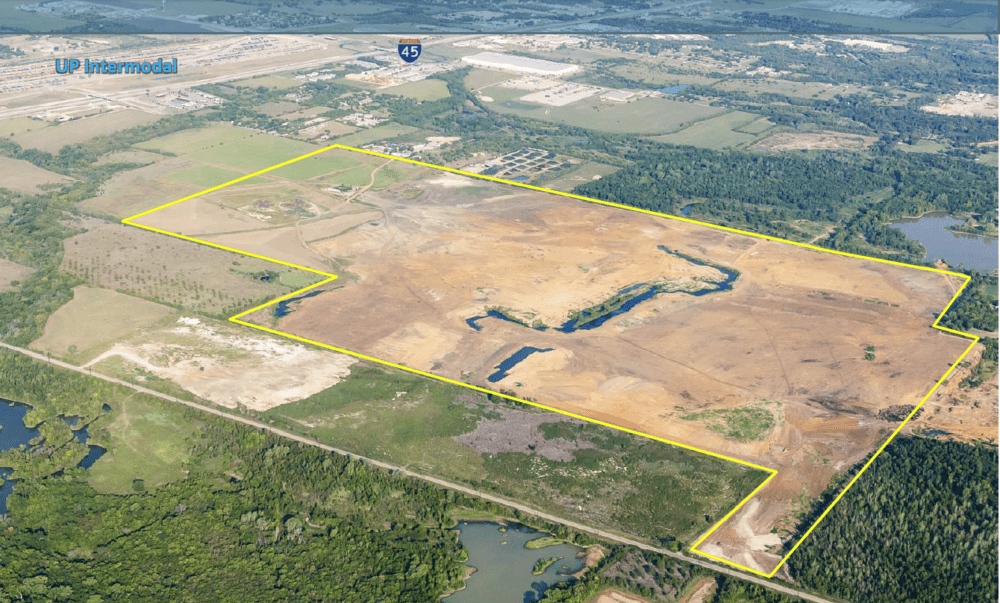

The most recent addition of two California companies has people talking. In March, CT Realty Investors and Xebec Realty Partners partnered up to purchase a 530-acre site near Interstate 45 for the development of Southport Logistics Park. The real estate investment companies will build nearly 9-million square feet of distribution and e-commerce space, and host real estate development projects.

Texas Gov. Rick Perry capitalized on the state’s favorable business environment during a recent trip to California. In a radio statement that quickly spread to other media outlets, Perry announced that “building a business is tough, but I hear building a business in California is next to impossible. This is Texas Gov. Rick Perry, and I have a message for California businesses. Come check out Texas.”

While the recent addition of CT Realty Investors and Xebec Realty Partners might suggest a trend of California businesses moving to Texas, economists from The O’Neil Center for Global Markets and Freedom at Southern Methodist University said that individuals are also migrating to the Lone Star state.

“I would suspect that the same forces that are causing individuals to move from California to Texas are pretty much the same ones that underlie the motives for businesses,” said writer-in-residence Richard Alm, who previously served as the senior economics writer at the Federal Reserve Bank in Dallas. “Businessmen aren’t aliens, and we have no reason to believe they have a different set of values, different set of incentives, or a different set of responsibilities as individuals.”

In The Center’s 2010 annual report, “Looking for the New New World”, Alm and SMU professor W. Michael Cox estimate that California lost 148,000 residents to Texas from 2004 to 2008.

The researchers’ report identifies taxes, unions, government spending and home prices as the driving influences behind state-to-state migration. According to statistics compiled during 2004 to 2008, Texas had a more favorable economic environment than California.

With no state income tax and a lower unionization rate, Texas is a stark contrast to California’s 10.6 percent income tax and 17.8 percent union membership rate. When Texas’s local and state government spending declined by 10 percent, California’s increased 25 percent faster than the national average. And in Texas, housing prices were a third of what they were in California.

While the statistics favor Texas, economic incentives aren’t always enough for individuals and businesses to leave their state. California has beaches, mountains, and other topography that are harder to come by in Texas. And for some people, it’s all about the lifestyle.

Debra Roberts, a senior mortgage advisor for Samuel Scott Financial Group in San Diego, doesn’t see the company, or the one she previously worked at for 19 years, leaving California for Texas.

“Both companies are larger private family-owned companies, where the families have raised a couple of generations in California,” she said.

Alm said he doesn’t think Gov. Perry’s recent trip to California, when he made his radio statement urging people to flee to Texas, influenced businessmen and women. Californians make decisions based on hard data and factors that affect their business.

“Perry’s little trip was good political theater, but marginal in terms of affecting people’s business decisions,” he said.

Despite the recent buzz surrounding Texas’s growing economy and migration to the state, it’s old news for economists.

“We could have had this conversation in the 70s, but they started having this conversation three or four years ago. It was exasperated by the financial crisis and recession, and that magnified the difference,” Alm said.

Xebec Realty Partners and CT Realty’s 530-acre development site in south Dallas (The Dallas Morning News)