With Rick Santorum’s exit from the presidential race this past week, the general election campaign between Mitt Romney and Barack Obama has officially started.

Barack Obama’s first move in the general election campaign, the pushing of the so-called “Buffet Rule”, illustrates what the dominant theme of his reelection strategy is going to be: fairness.

The Buffet Rule is the proposed tax-hike on millionaires and billionaires that would ensure that they pay at least 30 percent of their income in taxes. Since most wealthy people, like Mitt Romney, earn their income through investments and capital gains, and therefore pay a 15 percent rate, this is essentially a doubling of the capital gains tax rate.

The reason that capital gains are taxed at a lower rate than wages is because people have already paid taxes on the money they use to invest and earn capital gains. So, the government is already double-taxing capital gains. In addition, there is no guarantee that your investments will pay off. You could lose everything you invested, or it might not really pay off for years. Doubling the capital gains rate will dramatically slow investment in just about everything, because the risk will not be worth it if you are going to have to pay at least 30 percent of your earnings to the government.

President Obama, in several campaign and supposedly non-campaign speeches (this president hasn’t been governing since August, so really everything he does is a campaign move), has said that this rule will raise revenue so we (the government) can invest in education and green technology and some other of the president’s pet projects and reduce the deficit.

By continuing to claim this, President Obama is again showing how he doesn’t listen to anyone but himself.

The non-partisan Congressional Budget Office this week took a look at the Buffet Rule. If implemented, in the next ten years it would bring in the massive sum of an estimated extra $47 billion.

That’s $4.7 billion a year. This makes little instinctive sense. If you double the tax rate, the amount of money the government takes in should double, right?

Well, no. The CBO projects that the amount of investment will go down, the rich will find more loopholes to hide their money from Uncle Sam and that people will hold their investments for longer. Lower taxes act as an incentive for an activity, so higher taxes act as a barrier to an activity. We want more investment, especially in this economy. Therefore, this policy is a terrible one.

In addition, considering that our budget deficit this year, for the fourth time in a row, will be over $1 trillion, $4.7 billion is literally nothing.

At that rate, the Buffet Rule would pay off the 2011 budget deficit by the year 2330. I really understand now why so many people find President Obama so inspiring and intelligent.

This is the problem with President Obama’s policy position of just raising taxes and never cutting any government spending: it just won’t work.

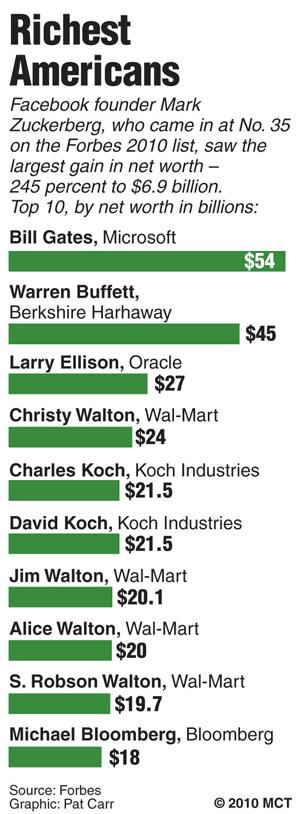

If you confiscated the wealth of all of the people in the Forbes 400, you would get around $1.5 trillion. We could pay for about one more year of Obama deficits with that.

Where would we go for money next? Sure, there are more rich people than the Forbes 400, but they don’t have enough to continue paying for the government behemoth: they already pay 86 percent of the tax burden, a number which has increased with the Bush tax cuts.

Eventually, if we continue down this path of trillion dollar deficits, no entitlement reform and ever expanding government, the middle class is going to have to pay much higher taxes as well.

Our country has serious problems. We need a serious president who will actually attempt to tackle these problems, not one that offers only political gimmicks, intense partisanship and poll-tested platitudes that will do nothing to address these issues.

Andrew is a sophomore majoring in finance, French and markets and culture.