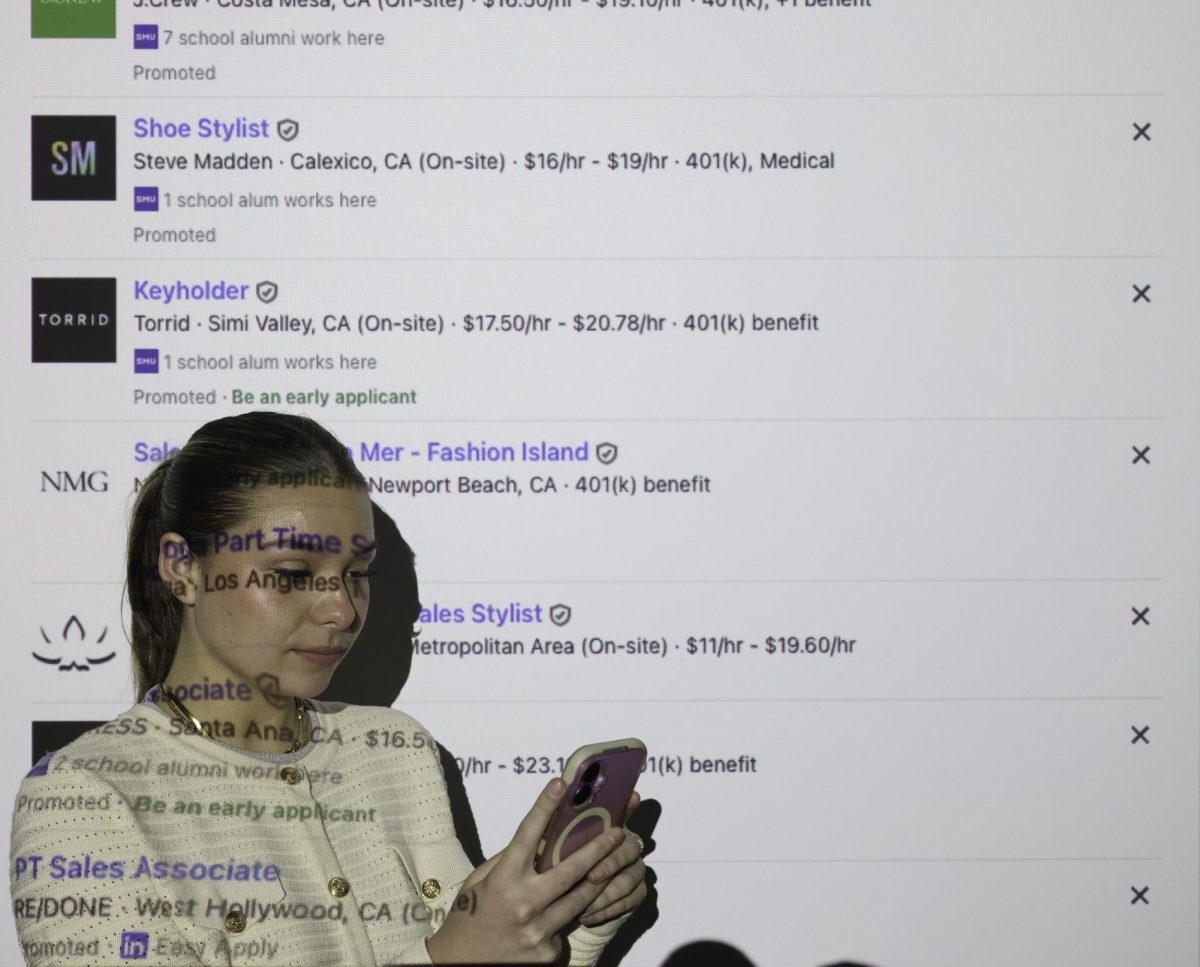

Senior writer for The New York Times Diana Henriques lectures in Crum Auditorium about the current financial crisis Tuesday afternoon. (Stuart Palley)

The United States is in the midst of a financial meltdown. The banking system has come closer to collapsing than many experts ever thought possible. But this isn’t a surprise to Diana Henriques, and the greater business journalism community, who all saw this crisis coming.

“Throughout 2007 we ran a drum beat of warning stories about these accelerating risks. We were clanging the fire bell right through 2008. I make no apologies for how my paper covered this financial hurricane,” Henriques said.

Henriques is a senior business writer for the New York Times. She discussed the distrust of mainstream media despite the fact that the media has been forewarning of the impending financial crisis at the O’Neil lecture in Crum auditorium Tuesday afternoon.

Henriques said the business media had its miscues before with the savings and loan crisis of the 1980s as well as “coming late to the party with the internet bubble.” But she felt that the coverage and foresight of the financial media was spectacular for the current crisis that we are in.

“We called it right and we called it early,” Henriques said. “The government, the industry and the American public, if they had only paid attention would have gotten ample warning about this years in advance.”

Henriques said that there were multiple reasons as to why the warnings of the media were ignored. She said it is partially due to faults with the news model such as the “paradox of 24 hour news, as markets become more and more complicated, news coverage becomes less so,” Henriques said. She said to keep the attention of today’s average viewer it was necessary to constantly change the subject to keep interest. As a result, the little time spent on coverage of the credit markets was insufficient to fully inform the American public, Henriques said.

According to her, part of the lack of attention paid to the media to the government discrediting the media as biased, just pushing their agenda.

“She really is right,” Professor Mark Vamos, Chair of the William J. O’Neil business journalism program, said. “There were real times when people didn’t want to hear what the press had to say. During the housing bubble, people didn’t want to hear it because they were getting so rich in the bubble.”

Henriques also said that part of the problem was that corporate executives and businessmen like Secretary of the Treasury, Henry Paulson, and Federal Reserve Chairmen Ben Bernanke are not astute when it comes to communicating with the American public.

“Whatever they know about the financial world, and I am sure it is a lot, they know next to nothing about talking plainly to the American consumer. This makes it difficult for the public to get the information that they need,” Henriques said.

Frank Roby, Chief Executive Officer of Homes and Murphy law offices, as well is on the board of directors agreed from a business perspective saying that in general business people are not prepared to interact with the media.

Henriques said the only way for the American public to regain their trust and pay attention to the media is for them to trust credible news sources and not worry about partisanship in the media.

“If your house is on fire you don’t care if it is a Democrat or a Republican warning you to get out,” she said.

Junior finance major George Enriquez agrees that the media did call the crisis in advance, saying that in his summer internship in 2007, he could recall CNBC discussing forth coming issues with the sub-prime mortgage market. He also said that the current media coverage was on par with the severity of the issue saying, “I don’t think we have seen the full effects of the crisis yet and I think the media needs to press its coverage to keep up with the continuing crisis.”