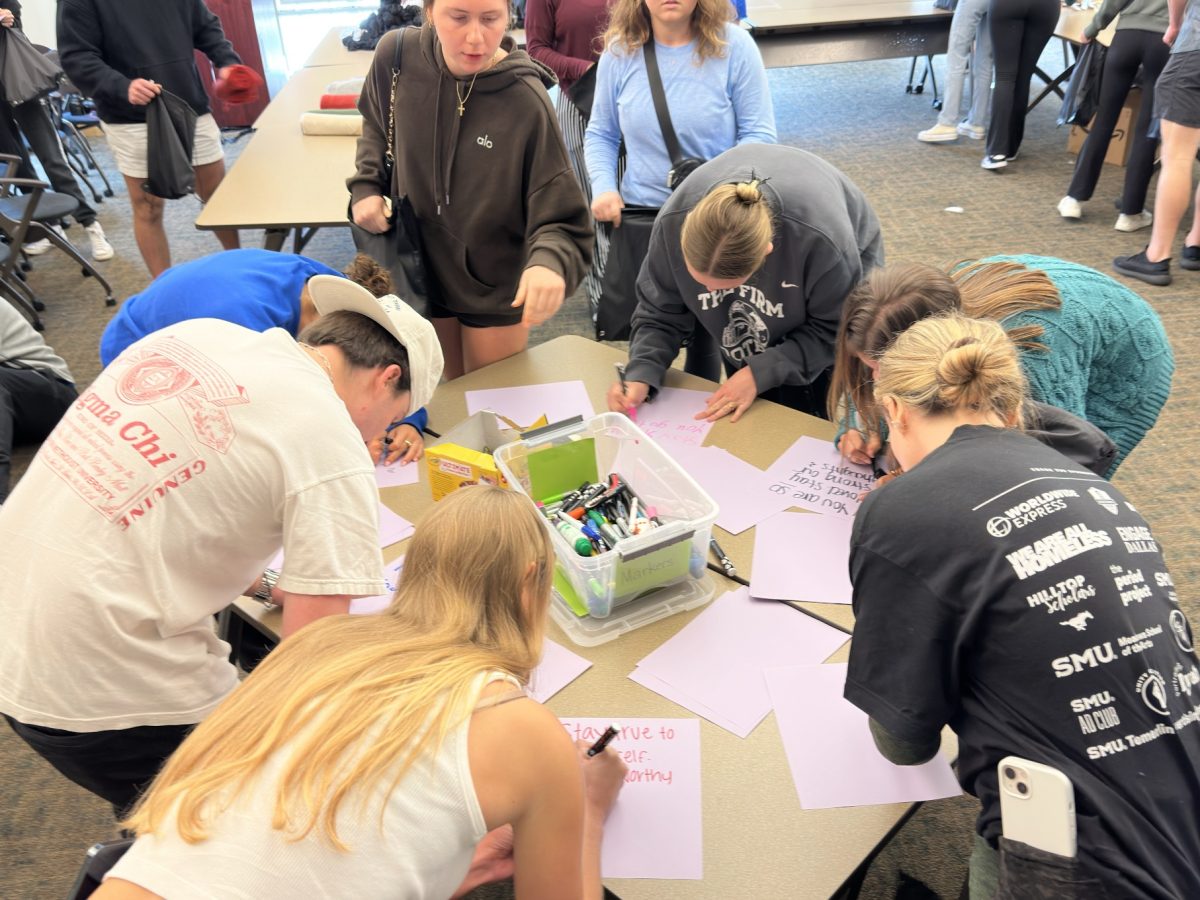

(HELENA BOLOGNA/The Daily Campus)

Whether or not you’ve been a victim of identity theft, everyone can do a few things to stay on guard to protect their finances. It happens all the time – you’re out at a bar or a party and the next thing you know, you can’t find your wallet.

There’s nothing worse for a man than the feeling you get in your stomach when you realize you were stupid enough to put your wallet in your back pocket. If you decide to take the full-blown bi-fold, be sure to keep it in your front pocket. And ladies – take a wristlet and don’t let it leave your person. This will prevent you from dumping your valuables and forgetting them wherever you decide to sit down for a conversation.

Better yet, why not just take your ID and cash when you go out? While you may lose some cash in the worst case scenario, you won’t have to endure the headache of cancelling cards and replacing them. This may not be the most realistic option, but it’s probably the safest.

It is a good idea to keep a photocopy of all your IDs and cards in the case of theft. Scan the document and make it password protected. If anything ever happens, you will have the information handy to communicate to your bank.

Save the bank customer service numbers in your cell phone so you can take immediate action, assuming you don’t lose your phone. Typically it can take a few days to replace your card. Banks will often give you a temporary card, but you may want to keep a stash of cold hard cash handy at home.

Another form of identity theft that could easily go unnoticed takes place online. Be sure to monitor charges and report suspicious activity to your bank immediately. Don’t save credit card information online.

If you have credit cards, check out your credit history to make sure everything is accurate. You are entitled to one free credit report once a year. Go to www.annualcreditreport.com to see if there is anything fishy going on.