When Matthew Schortman’s parents were looking for a gift for their SMU junior in 2006, they passed on the digital cameras, PlayStations and HD television. Even a new car for their son wasn’t what they were looking for. All of those things would depreciate once they were picked up off the shelves or driven off the lot.

The Schortmans wanted to give their son something that would benefit him in the long term, and they weren’t looking at an Encyclopedia Britannica set. They were looking for property.

“They had some money sitting around they needed to invest in,” Schortman, a senior economics and finance major, said.

He lives in a three-bedroom townhouse with two friends just west of Snider Plaza and will soon reap the financial benefits from his parents purchase.

Today, more college students are becoming property owners, a title once reserved for the older and wealthier demographics. A recent increase in real- estate prices is most likely the cause for this trend. Because of the standing market conditions that surround college campuses, the opportunities for a younger generation to own appreciating real estate are great. Wealthy parents and students with the ability to buy property are benefiting from these conditions. The real-world experiences the new landlords are receiving through this process are indispensable.

In comparison with the rest of the country’s sickly real-estate markets, campus-based markets are thriving.

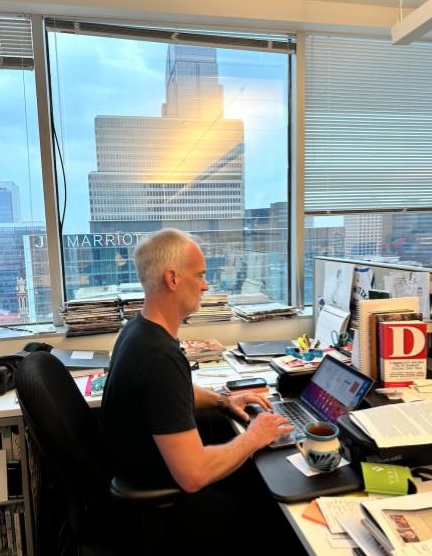

“It’s an excellent investment over the long term to have housing near a college campus,” said Chuck Dannis, the president of Crosson Dannis Inc., a Dallas-based real-estate appraisal and consulting firm that operates throughout the United States. Dannis is also an adjunct professor of real-estate finance in SMU’s Cox School of Business.

Graduating with a return on an investment is an attractive offer for students. Dannis says that buying properties near a college campus is almost a sure bet because they are mostly in land-constrained markets. These are areas in the denser parts of cities where there is not a lot of new supply that can develop and lower property values.

Especially in cities such as Dallas, Austin and even Ft. Worth, the housing markets surrounding universities are steady. However, schools in more sprawling cities, like Texas A&M in College Station, and schools in metropolises like Boston may not be receiving the same benefits as buyers near SMU. More land available for development and increasing populations hinder the success of these markets.

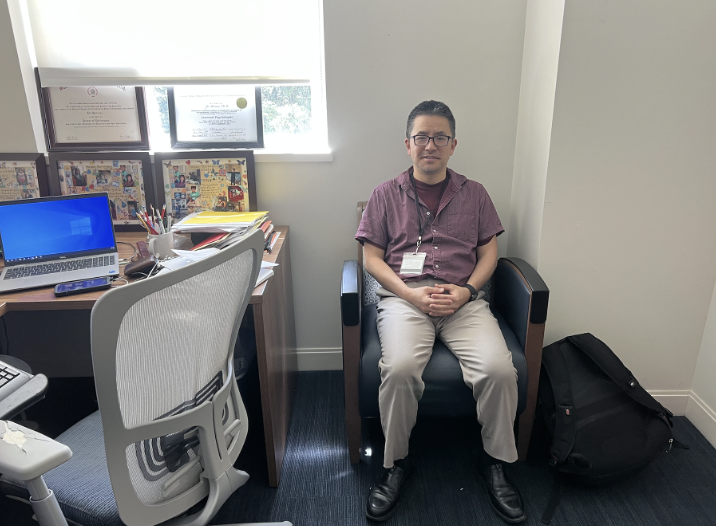

Sophomore Travis Newkumet believes that owning property anywhere within proximity to SMU is a good investment. Newkumet sold interest he had in his father’s oil wells and used that money to buy a three bedroom condo a mile and a half from campus.

He rents the bedrooms out to three other SMU students now and makes a $200 profit each month. If he lived in the condo, he could still lease out the two other rooms and live for free.

“It’s not an expense, it’s an asset,” said Newkumet, a finance and economics double major.

When he graduates, Newkumet wants to develop commercial real estate and sees owning a property while still in school as indispensable experience.

“Anyone can go to class and learn about real-estate financing,” he said. “But being out there buying and selling- it will stick better in your head.”

Senior A.J. Undorfer’s parents jumped on the chance to purchase a three-bedroom condo that was nearing completion near the end of their son’s freshman year. Undorfer also has a twin sister, Alexis, at SMU. The condo is walking distance from campus and is likely to appreciate in value by the time the twins graduated.

“Properties usually appreciate five percent a year,” Dannis said. “Arguably you could have a 20 percent increase in property value just by the time you graduate from college.”

Newkumet modestly estimates that his property will increase 20 to 25 percent by the time he graduates in 2010.

Even if students aren’t the ones whose name is on the deed, their parents can stand to benefit from owning residential property near a college campus, too. Dannis says if a family has three kids who go to SMU, owning a condo near campus will save them a lot of money that would have otherwise been spent on monthly rent checks.

This possibility rang especially true for the Undorfers.

“I live in my condo with my twin sister and another friend,” said A.J. Undorfer, a senior markets and culture major. “My little brother is a freshman, so he has three years of partying to look forward to in this apartment.”

Schortman’s parents bought his townhouse, as well as the adjacent townhome for his sister, a junior at SMU. The homes were placed in a family trust to allow the children to benefit from the investment once they graduate.

Like Newkumet, Schortman said the experience he has received from managing a property has been the best investment overall.

“It’s a good learning opportunity because I’ve been in charge of managing the HOA, paying the insurance and the taxes and all the bills,” he said. As for his future, Schortman plans to work in real estate development or analysis.

“I’ll know what to look for now for investments,” he said.

The Federal Housing Administration offers a special loan for young adults to get started buying their first home called the Kiddie Condo Loan. According to the FHA Web site, this type of loan allows a person to “co-borrow” funds with a relative, using the relative’s assets as collateral. The co-borrowers take title to the property and sign for the loan.

The down payment on a Kiddie Condo Loan is only three percent of the property-purchasing price. This is minor, considering what Dannis says the return on an investment can bring for someone who is just barely out of college.

Are there any drawbacks to owning property as a college student, rather than renting an apartment? Dannis says the lack of a property or maintenance manager might be missed among the landed gentry.

“If you own it and the toilet breaks, you have to fix it.”