The costumes and candy of Halloween have passed and college students now have their minds focused on the joyful activities that the upcoming holidays will bring: meals with family, singing carols, and opening presents. So how do students celebrate the holidays with their college friends before finals are over – at their “home away from home” – on a college budget?

As we all know, students use their money for fun activities as well as necessities. To make sure you’re not strapped for cash towards the end of the semester, using a budget could help you keep track of your money.

Some may think that creating a budget is time consuming, but all you really have to do is take note of the cash supply you have at the beginning of each month and the amount of money you spend each month – making sure that the cash you spend doesn’t exceed the amount of cash you have.

It seems easy enough, but according to a University of Louisiana at Lafayette study, very few students use a budget, even only sometimes, to manage their money. The study showed that about 73 percent of freshmen don’t use a budget whatsoever and concluded that many students could be “vulnerable to financial crisis.”

Budgeting money is important for every college student. It may seem like a hassle, but making sure you have enough cash ensures that you can afford to pay for things you need like food, gas, and rent.

Even if a student does use a budget, he or she may not have sufficient funds to do anything special for the holidays with their friends. A lack of cash makes it hard for students to celebrate with their friends before going home after final exams are over.

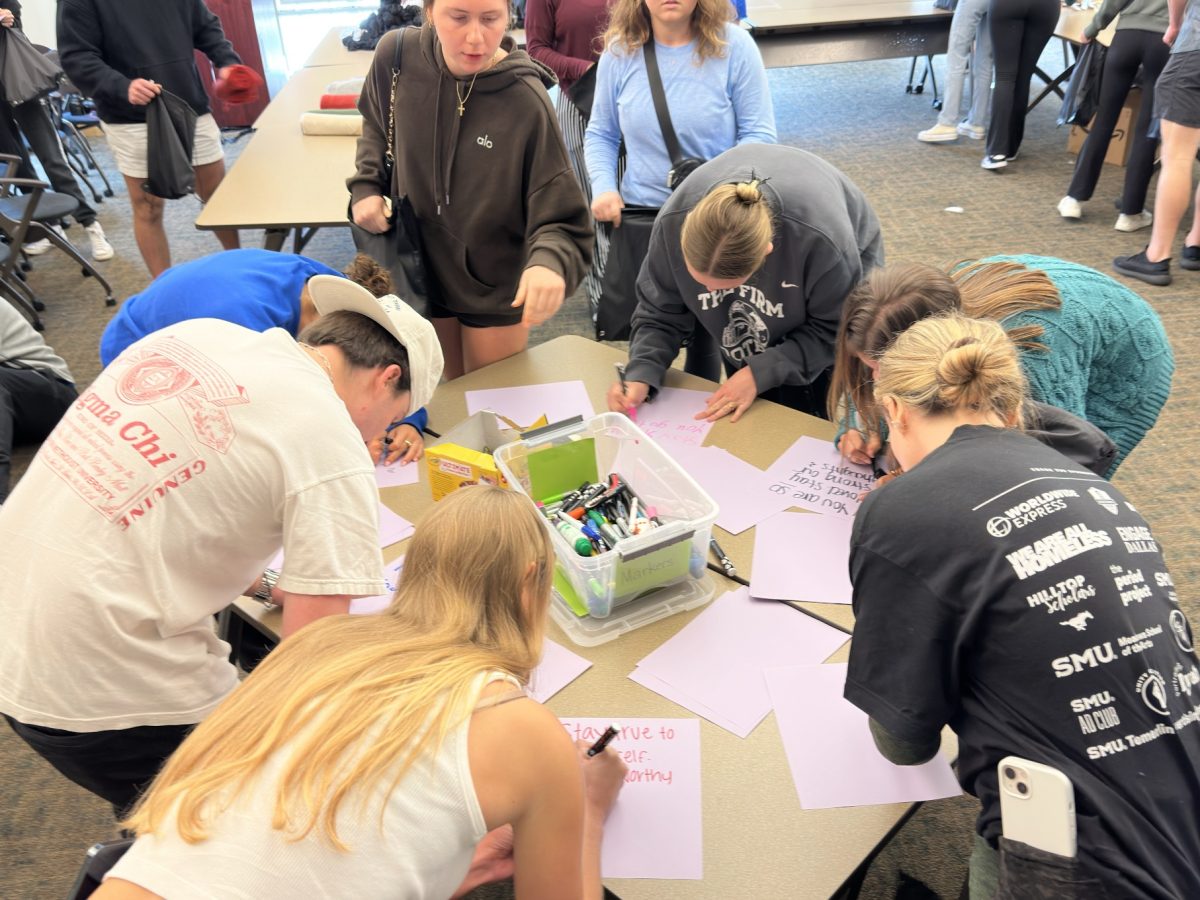

One wallet-friendly solution would be to organize a “Secret Santa” gift exchange with your friends. Many college students have a small budget for extra activities, so buying only buying one gift ensures that you stick to your budget rather than overspend.

“My friends and I are thinking about doing a gift exchange,” said junior Megan Aselton. “That way you only have to buy one gift, and everyone ends up receiving something.”

Making a budget doesn’t have to be time consuming or complicated. For example, sophomore Liz Dubret used her skills with Microsoft Excel to keep track of each expense she incurred while abroad in Oxford last summer to make sure she stayed within her budget.

Another option is just as simple as checking your account statement online every few days to keep track of your spending. Some banks even make it easy to check your statements on the go.

Ashley Nickels from the Chase Bank branch right off campus says Chase has an app for your cell phone. You can look at your account balance and recent purchases you’ve made as well as take pictures of your checks and deposit them directly from your phone.

Having a game plan to effectively manage money is vital, so whatever method you choose, taking control of your expenses will surely pay off in the long run.