While the Alternative Asset Management Program is arguably the best program at SMU – in terms of national credibility and future salary – very few SMU students know about the program.

The program is part of the finance major and is for students who know early on that finance is what they want to do and have decided that it’s something they really like.

“If you’re really interested in alternative investments or you’re interested in a future in hedge funds or private equity, then this is the program you need to be in because it sets you apart,” SMU senior Stephen Meek said. “Once I got into the program … it really just bolted my career at SMU because it made me realize where I was, what I needed to get done, and it challenged me and I really gained from it.”

To get an idea of how highly selective the program is, there are 22 students from the program graduating in May. Next year’s class will only have one additional student.

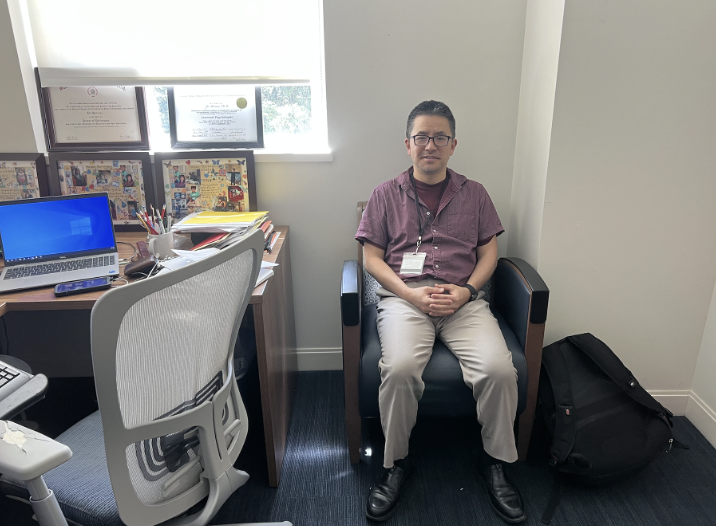

“I don’t know schools that have an exclusive program like this where they only take a very relatively small number of students and give them this kind of training. We’re obviously investing a lot of resources for 23 students, so it’s a big investment on the university’s part,” director of the EnCAP Investments & LCM Group Alternative Asset Management Center Don Shelly said.

Cox undergrads can apply for admission to the program during the fall of their junior year.

The average GPA for acceptance into the program is above a 3.8, but students are also selected based on leadership, integrity, initiative and work ethic.

“Grades aren’t everything, but they’re very important. You need to be doing well in your freshman and sophomore classes even though you won’t be taking business classes because that’s going to be the bulk of your GPA when you’re getting ready to apply,” Shelly said.

Once accepted, students are required to complete two alternative assets courses – the first during spring semester junior year and the second during spring semester senior year – and an internship. The setup is intended to allow for students to have an internship in between the two courses so they gain the academia experience as well as the professional experience.

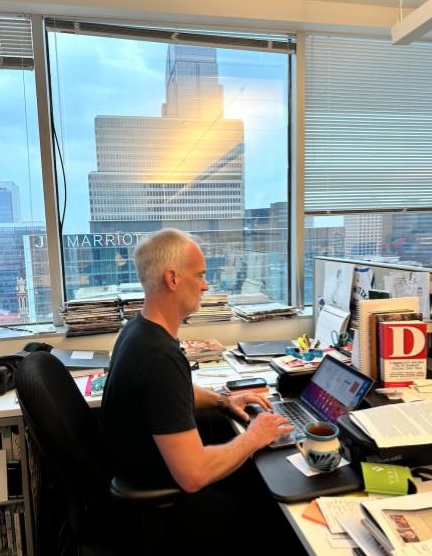

“The whole kind of overarching goal is that we really want to give our students the opportunities to be competitive with anybody,” finance department chair and professor William Maxwell said.

SMU senior Lizzy Chesnut, one of the students in the program, already has a job set up for after graduation with oilfield services company Halliburton in Houston. For Chesnut, the guest lectures are one of the most beneficial aspects of the program.

“We kind of learn about the issues, and it’s really real world related versus where a lot of classes are kind of more academic and theory based,” Chesnut said. “I think overall it just kind of prepares you better for starting your first job.”

Some of the outcomes of the program are the internships junior year and job placements for after college.

While the internships pay well – prorated $50,000 to $70,000 – the hours are intense.

During the internships students work an average of 60 hours a week, sometimes even averaging up to 80 hours a week.

In terms of jobs, the median starting salary was about $72,000 last year.

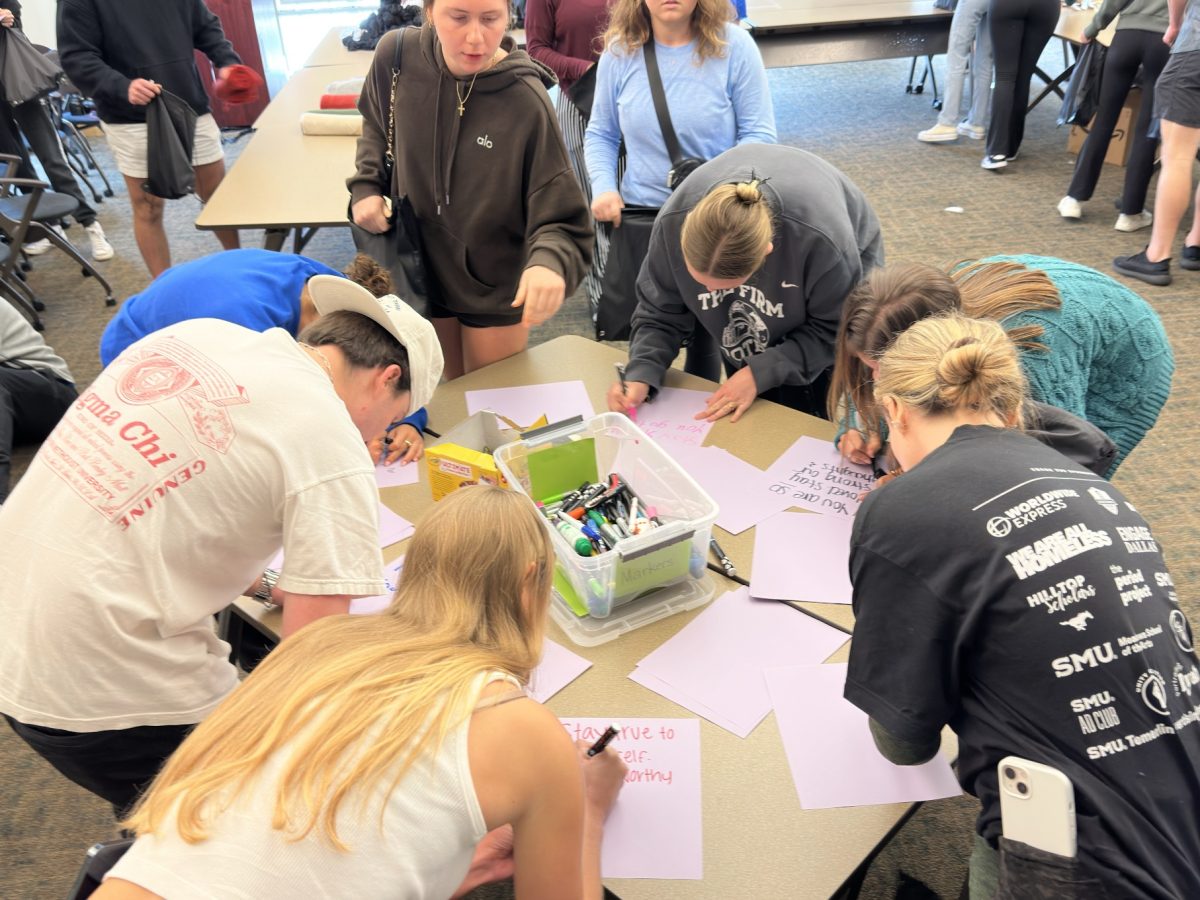

The payoff for the program is increasing student demand for more intensive programs.

“Programs like this are essential for all SMU students who want to pursue very specific fields,” Mehdi Hami, a first year, said. “I hope there are fields like this in medicine, engineering and the liberal arts in years to come.”