Kevin Murphy, a public affairs representative for ExxonMobil, gave a lecture about the company and future energy trends Tuesday. (Nick McCarthy)

Kevin Murphy, a public affairs representative for ExxonMobil, spoke to the Chemistry Society and other students yesterday in Fondren Science Building about Exxon and future energy trends. Although the presentation focused on energy trends of tomorrow, fuel emissions and alternative methods to conventional gasoline, there was no precise information provided regarding what percentages of Exxon’s income are directed toward future development.

The company acknowledges that the greenhouse effect and gas emissions have dangerous effects on the ecosystem and the global temperature, but approximately 40 peer-review papers have been produced within the last 25 years. The company also maintains that the demand for oil will only increase between 2005 and 2030. In order to appease shareholders and world demands, the company must supply oil and gas to the growing global economies.

Edwardo Manzur, who has a Masters of Science in Engineering Management, attended the presentation to gain more information about energy resources. “This is one of the most important subjects currently facing the economy today, so every engineer should focus at least a little bit on energy resources,” Manzur said. “Blood is for arteries what energy is for the economy.”

The presentation noted that economic growth in countries such as China is increasing the demand for oil and therefore the gas prices are going to rise accordingly. According to ExxonMobil’s 2005 Energy Outlook Highlights, the global energy demand will increase by 50 percent between 2005 and 2030 because of growing economies and populations.

According to an information packet provided by ExxonMobil, “Oil, gas and coal remain the predominant energy sources, maintaining about an 80 percent share of total energy demand through 2030.”

The company received a record profit for 2006 of $39.5 billion. Murphy was unable to give a percentage of the amount of profit that was dedicated to future energy supply. When an audience member stated that he believed ExxonMobil was contributing 5 percent of profits to future energy development, Murphy responded, “I think that’s probably right.”

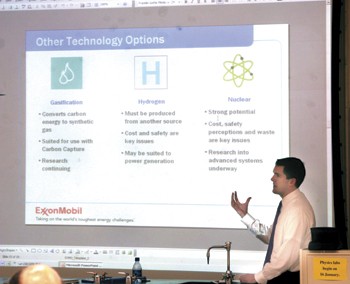

The information provided by Murphy also conveyed that the company is aware of the need for new energy sources, and that access to resources and timely investments are vital to developing adequate energy supplies. Murphy stated that ExxonMobil’s technological investments are important because they are able to cite many patents. Exxon invests more than $600 million per year to research and development. This number is close to the exit bonus of $400 million awarded to the departing CEO of ExxonMobil in 2004.

“It’s good to see some real stats,” junior Erin Matlock said. “Things get diluted through press so that you don’t always see stats from energy companies themselves.”