Local businesses left out in the cold

Carolyn McCartney Culbert is frustrated.

For three years, she has been trying to get Express Cash, thepopular campus debit card, accepted at her store on HillcrestAvenue.

Culbert, who owns McCartney’s, says that when the programwas still in the planning stage, “[the school] said that ifthe opportunity arose for merchants like McCartney’s to be apart of the program, they’d notify us.” However, afterdiscussions with the school and Blackboard, the outside companythat acts as the liaison between SMU and off-campus Express Cashmerchants, Culbert has given up her efforts to join, claiming thatthe last thing she heard from the school was that there is nochance her store will be able to use the card.

Julie Wiksten, director of Auxiliary Services for SMU, verifiedthis, saying McCartney’s, Flash and Varsity Bookstore willnot be able to use Express Cash.

Wiksten said that she knows these are stores students areinterested in, but that the school has agreed to exclusive businessarrangements with Aramark, which coordinates dining services, andBarnes & Noble, which runs the SMU Bookstore.

She says that the university is not allowed to endorse anystores that would directly compete with these companies, and thatextending the use of Express Cash to such locations is not anoption.

She said restaurants are allowed because their inclusion in theprogram does not seem to negatively impact the success of on-campusdining services.

“The reason why we haven’t just flung the doors openwide is that there is a commission paid back to the university forexclusive relationships,” Wiksten said. According to her,this money is more beneficial than the percentage the school getsfrom Express Cash sales off campus.

“Blackboard takes out a percentage that they negotiatewith each [off-campus] vendor, and we get a percentage of thatpercent,” she said.

Culbert is not the only merchant upset by this mandatoryexclusion. Cheryl McIntosh, manager of Varsity Bookstore, and JulieKang, manager of Flash, both say that they would like to be able toaccept the card because “pretty much everyone uses it,”Kang said. McIntosh and Kang believe they would experience anincrease in sales if Express Cash were accepted at theirstores.

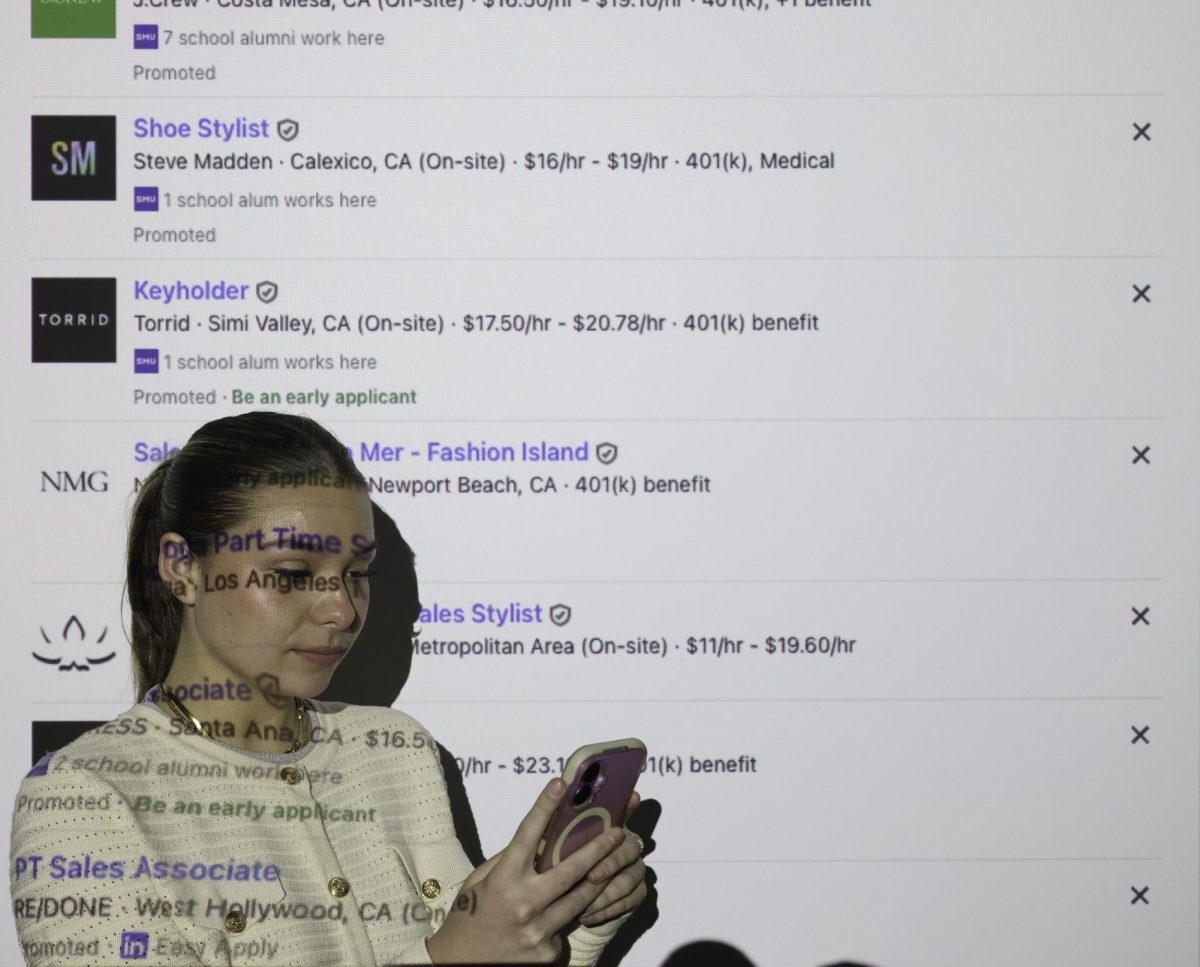

Many store managers and owners do not understand how, or if,they can qualify to accept Express Cash at their establishment.

“No one has really been willing to give us a directanswer.,” said Varsity Bookstores’s McIntosh.”They kept referring us to different departments. We’vekind of been given the run around.”

Wiksten said which stores can participate is partly decided bystate law. She said that if there is an on-campus business thataccepts Express Cash for its services, a similar off-campusbusiness is then eligible.

“Here is a perfect example: we had a haircutting placethat wanted to participate, but there is no similar on-campusservice that accepts Express Cash,” Wiksten said. Because ofthis, the off-campus business had to be turned down.

Parameters also play a part in the decision.

“We’re not wanting to extend the program real faraway,” Wiksten said.

The school wants to keep the program close by because, Wikstensaid, although farther locations might see some traffic from SMUstudents, such activity will probably not be a key component oftheir sales.

She said that special care is taken with establishments thatserve alcohol, such as La Madeleine. Alcohol and cigarettes cannotbe purchased using Express Cash, and Wiksten dispatches studentsecret shoppers to ensure that this regulation is adhered to.

Students and merchants often complain about the lengthy processinvolved in the decision of whether or not a vendor will beadded.

Jake Watters, manager of Jimmy John’s, says that”it’s nearly impossible for a new business to get on[the program].”

The sandwich shop, which opened on July 7, 2003, was able to doso after six months of tenacious telephone tag with both the schooland Blackboard.

In December, Blackboard called Watters to tell him that theschool wanted to immediately add Jimmy John’s to the list ofvendors that can accept Express Cash. He said that this call was”out of the blue”because only two weeks prior he hadbeen told that the school was not currently adding any newlocations.

“It’s a benefit because you get a whole new pool ofkids over here — but the downfall is the extra costs,”Watters said.

For Jimmy John’s, these costs include a 20 cent charge perExpress Cash transaction, 8 percent of the total transactioncharge, and $40 a month to rent the separate credit card terminalnecessary to participate in the program. To offset these costs,Jimmy John’s has raised prices by 25 cents a sandwich.

Wiksten said she does not believe this slows the rate at whichoff-campus locations are added to the program. She said she addsone or two locations each semester if she thinks it’sappropriate.

This semester’s new additions were Jimmy John’s andStromboli.