2008 was a stomach-churning year for finance majors nationwide. They sat on the sidelines watching as large parts of their industry came crashing down, destroying many of their potential jobs.

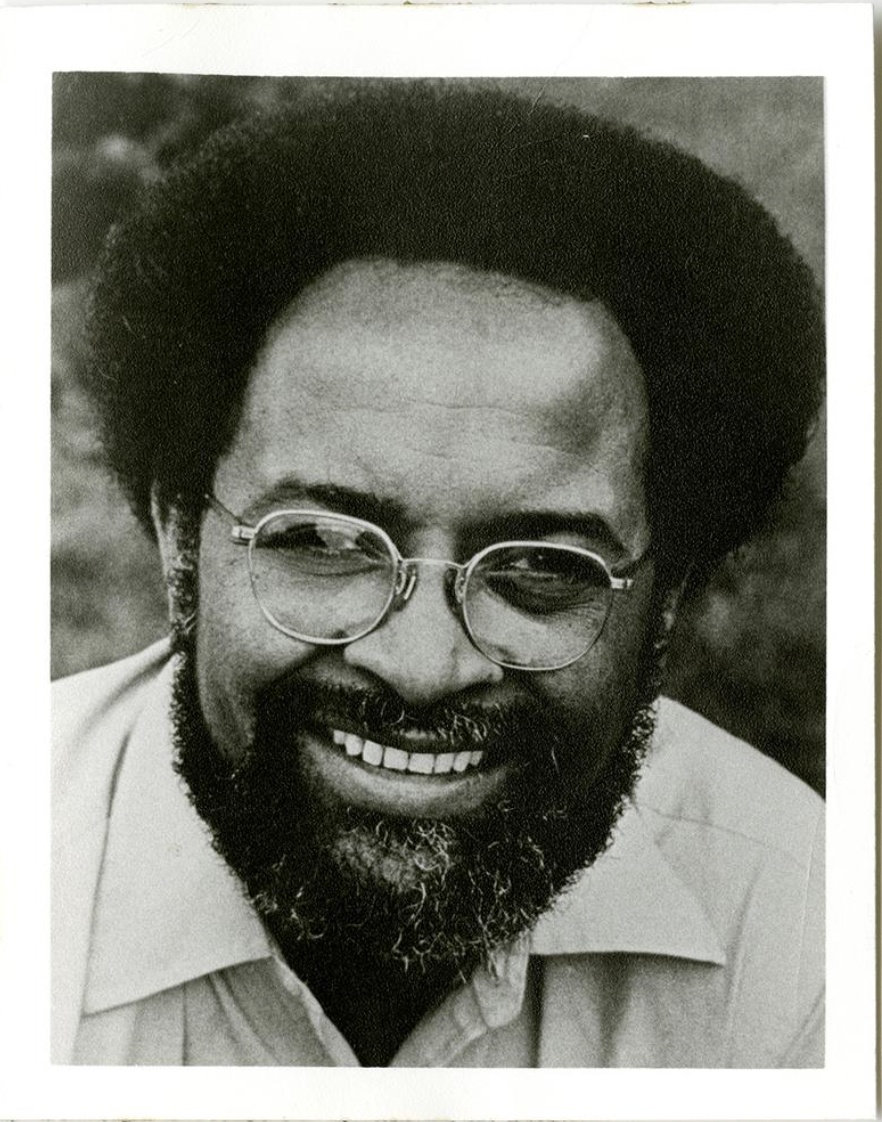

With the industry landscape rapidly changing, director for BBA career services, Roycee Kerr, organized a panel discussion of a wide range of industry professionals to talk about opportunities and offer advice to finance majors.

“We are trying to show the breadth of what you can do with a finance major,” Kerr said. “We want to give students a glimpse into various organizations, what some of their career paths could be, and show them the skills and experience necessary to get there.”

Different aspects of the finance industry were represented: banking, government, financial planning, and private sector corporate finance opportunities.

Finance in Banking

Banks endured a brutal 2008. The industry saw 200,000 layoffs, or about 10 percent of the workforce. Roland Tilden with Bank of America said the landscape has changed and finance majors will find many different rolls in the industry, rolls not seen two years ago.

“The entry points have changed. I know of an MBA working as a teller at one of our banks,” Tilden said. “My point is don’t expect to go through the finance training program like it used to be, we are always looking for finance majors to add value and knowledge, but now its just in many segments not traditional to finance.”

His advice was to decide what kind of customer you want to be closest to – wealthy individuals, start up companies, big corporations, or average American consumers. He said to tailor your careers from there. He said once you decide that, you can ask “What kind of difference do I want to make” and that can make things a lot clearer for you.

Kim Kittle from the Bank of Texas offered her advice as an undergraduate marketing major to develop salesmanship skills.

“Go through sales training – selling is important in whatever you do and it can prove valuable when you have to sell not only to customers, but to your bosses as well.

Public Finance

Shirley Alfred of the Office of the Comptroller of the Currency said there are many opportunities within the government for finance majors. She said that even though many may find being employed by the government boring, you can still find your passion.

“As a bank examiner you can delve into any industry you wish just about.”

She said the government hires finance majors for many different capacities, including banking analysts and portfolio management.

One advantage to government work, she said, is the potential for getting a good entry-level job right after graduation. The government can provide 6 months “on the job training” for the job you get. She said finance majors are ideal for many jobs because of their knowledge of financial statement analysis.

Financial Planning

According to Tyler Ozanne of Probity Advisors, the financial planning industry is poised for growth with many baby boomers approaching retirement, and many needing financial advice after a tumultuous 2008 decimated their retirement accounts.

He said that most of the Bachelor of Business Administration education that he received from SMU was focused around corporate finance rather than the personal side. He and his firm focus on the management of individuals’ and families’ personal finances.

“A financial adviser is like the quarterback of a football team,” Ozanna said. “We assess the family’s needs and go to portfolio managers and accountants to find ways to increase their cash flows and increase wealth.”

He said the best way to break into the financial planning industry is to become a shadow of a financial planner at a small or medium firm. It is possible to become a planner right out of college for firms like Edward Jones or Ameriprise, but he said that has, at best, a 30 percent success rate being a “professional seller.”

2008 instilled fear into the hearts of finance majors, but Roycee Kerr and the BBA career services center are trying to calm fears and show students options. This panel was the first in a series of similar career option panels. Next on the list: Marketing.