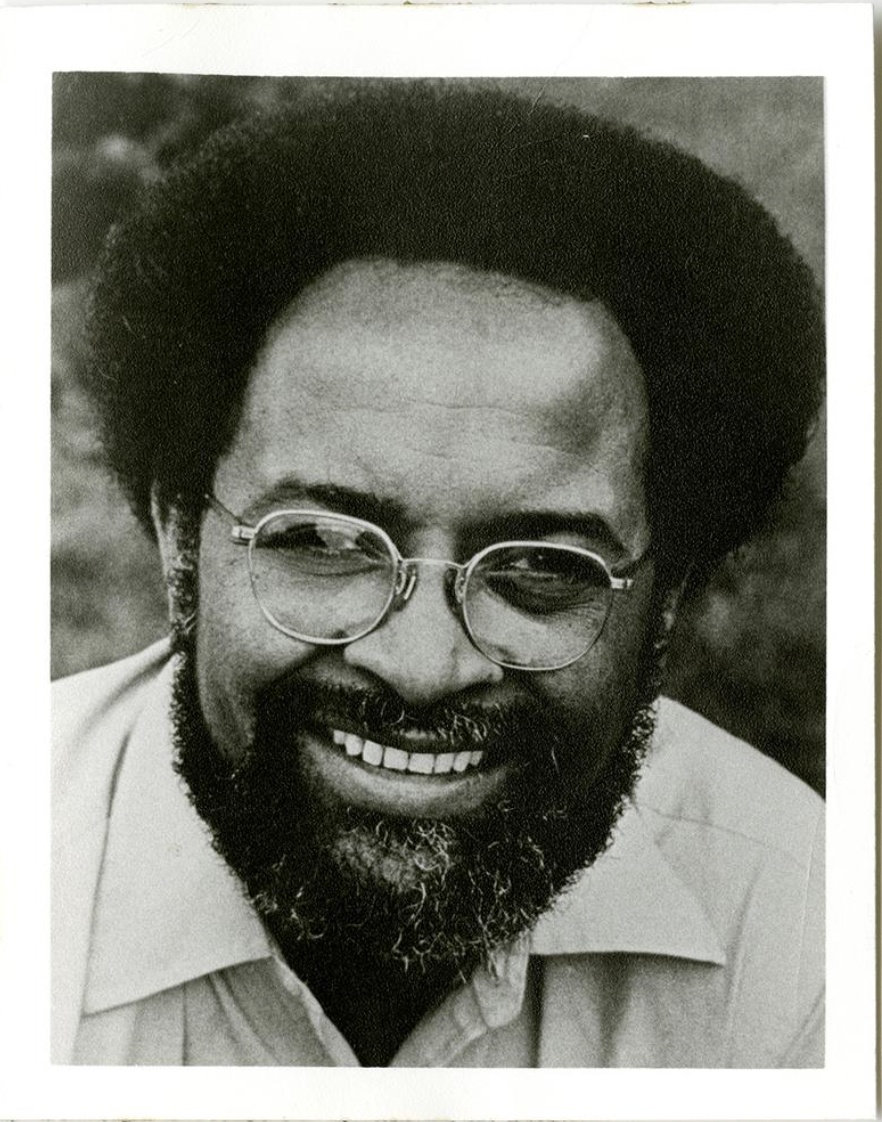

Junior Josh McGillian has a to-do list before graduation: travel and see the world, get washboard abs, and most importantly begin building his credit.

“I have plans after I graduate, get a car loan, maybe a mortgage, even that flat panel that looks so beautiful,” McGillian said. “All those things could cost a whole lot more if I don’t have good credit.”

Most students think that if they don’t have any negative marks on the credit that means they have a good score.

A credit score is also known as your Fair Isaac Corp. Score or FICO score. The score is an individual’s credit identity. This score, ranging from 300 to 850, determines individual’s credit worthiness and with that, interest rates for credit cards and borrowed money.

What most students don’t realize is a significant portion of a credit score, up to 15 percent depending on the rating agency, comes from length of credit history.

McGillian says before his college career ends he would like to obtain a credit card and begin building his credit history.

“My plan is to get a card and make some small purchases and pay off the balances on time, hopefully that will help me out down the road,” he said.

There are many options available to students when choosing a credit card, says Jason Bray, recent SMU grad and Bank of America loan analyst.

“There are cards ranging from instant approval to rewards, to cards designed for students with limited budgets,” Bray said. “The trick is to pick the one that is right for you.”

Bray warned that while there are good deals out there for students, there are also many predators trying to capitalize off of naive students.

“There are a lot of bad people out there that will try to lure in unsuspecting college students,” Bray said. “If you get into one before you know it your rates skyrocket and you are in debt up to your eyeballs – bad news for the credit score.”

Credit cards.com is a good Web site to compare credit card features and rates. There are many different options to choose from, including rewards credit cards, cash back, airline credit cards with frequent flyer miles, instant approval cards, cards for bad creditors, and student cards.

According to the site, the national average interest rate on credit cards is 12.35 percent, and students are on average paying 14.9 percent.

Bray said it is a good idea to get a credit card through a major company or bank that you are familiar with such as Visa, Master Card, Chase, Capital One, etc, to avoid the predator scams.

Julie Heartford has already started building her credit.

“I use my Nordstrom’s card when I go shopping usually,” Heartford said. “I try to keep it reasonable because I have to pay it off eventually.”

Bray said that it is important to pay your credit card bills in full and on time. Failing to do so can have a negative effect of the credit score he said.

Heartford recently became aware of the importance of her credit score.

“I just found out how to check [my score] and what it all means,” she said. “Now I can make sure I am staying on track.”

Individuals can check annually on their credit score for free at annualcreditreport.com. They can get their report from the three major credit agencies: Experian PLC, TransUnion, and Equifax Inc.

“Check your score, keep up with your bills, and be responsible with credit over time and it can save you thousands of dollars over your lifetime,” Bray said.