Republican presidential candidate Herman Cain signs a car tag, bearing 9-9-9, a reference to his tax reform plan, after speaking to the board of The Federation of Young Republicans Saturday, Nov. 12, 2011, in Atlanta. (Associated Press)

The Obama and Cain tax proposals of their respective 2012 campaigns are inextricably entangled with the politics of the moment. How much is about legitimate tax reform, and how much is a masked effort to curry favor with respective parties and gain support for the election, while promoting unattainable ideas and empty promises?

The intentions, results and inner workings of all components of politics are never black or white. The twisted ins and outs tangle together to form an ever-growing opaque blanket that conceals the true intentions of politicians and their various proposals— a gray area that promotes misconception, conspiracy, and speculation among confused citizens yearning for change.

Change was offered in Obama’s 2008 campaign for president. Change for a better, stronger, and more unified America. This grabbed the attention of voters in a desperate time, but what Obama promised was much more complex and difficult to attain than how he made it seem. This simplifying of issues into an easy solution is a common strategy utilized by presidential candidates to gain more traction on the ballot, and some speculate that Cain’s 9-9-9 plan presents itself as a perfect example of this tactic.

Anton Miller, a senior at George Washington University, commented, “[Cain’s] proposal is about a few things. First, it’s catchy and simple, meaning the media won’t have too much trouble reporting it and he can repeat the slogan over and over again. Second, it’s ‘bold,’ so people who don’t understand taxes will applaud that.”

The media is intricately tied to these two proposals as they put their own interpretations on them. So will voters interpret these two proposals as primarily political plays as opposed to substantive attempts at fiscal and tax reform?

According to Miller, “While Obama and Cain know their proposals can’t pass with a divided government, they think that the strength of their ideas can deliver an election to them.”

Cain, as a contender for the Republican presidential nomination, put forth his 9-9-9 proposal to grab attention, and appeal to his Republican constituents. The detractors of his proposal would say that it makes the poorer people pay a higher proportion of their income for taxes.

Obama, on the other hand, is trying to sound a chord with the Democratic base by saying he’s going to make the “rich” people pay their fair share. His tax on those earning over $1 million— close to an extra 6 percent— would help pay for the jobs proposal he recently unveiled.

SMU Economics professor Ravi Batra is a harsh critic for both sides of the campaign’s proposals.

As far as the Cain proposal goes, Batra offered, “[His] proposal is just a gimmick and will seriously hurt the economy as the poor will bear the brunt of its burden. When the poor are made to pay high taxes, consumer demand falls, so sales go down, some goods remain unsold and businesses have to lay off people.”

However, Batra was quick to balance out his evaluation of the Republican candidate’s plan with a questioning outlook on Obama’s proposal.

“Obama’s job proposal is his third attempt to create jobs, the first being the bailout package in 2009 and the second being the payroll tax cut of 2010. None of these has worked well and actually compounded the economy’s troubles. For instance, the bailout package was worth $800 billion and, according to Congressional Budget Office, generated about 1.5 million jobs. Dividing 800 billion by 1.5 million yields 533,000. This means that the government spent $533,000 to create one job.

Since the average wage is below $50,000, where did the remaining $483,000 go?” he asked indignantly. “Obviously, the money went to companies that hired those 1.5 million people. What a waste. So Obama has no credibility in job creation, and this may be why his proposal is not going anywhere.”

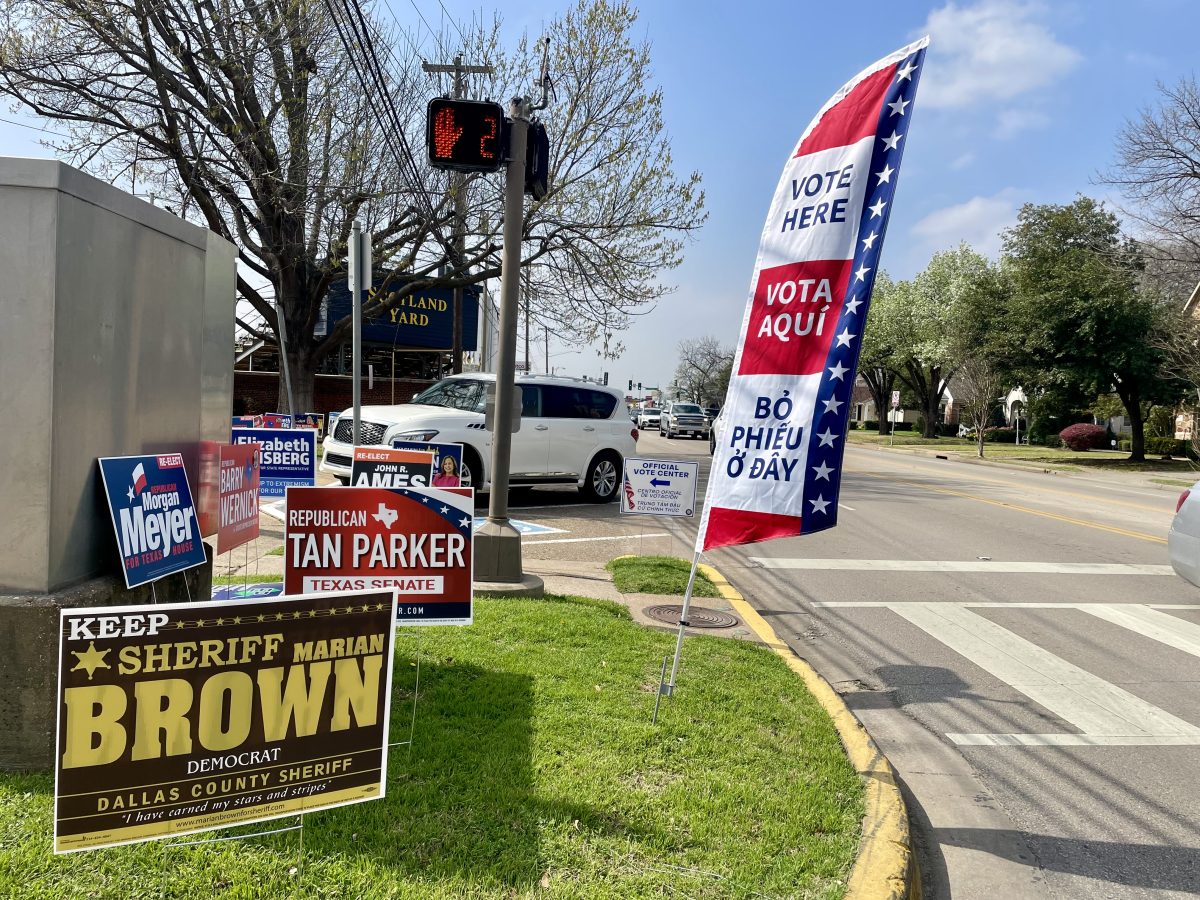

It is highly unlikely that the Republican controlled House of Representatives would ever approve Obama’s proposal, which to some makes it seem more of a purely political move. Republican Elizabeth Summer [her I.D.?] feels strongly that Obama’s plan is a play, while Cain’s plan is reasonable and spot-on.

“It boils down to redistribution of wealth—is the Federal Government in the business of redistributing wealth or is it in the business of providing for the national defense, coining money and performing duties as outlined in the Constitution. If we agree with the first premise than Obama’s plan is well on the way to doing just that; if we believe in the limited powers of the Federal Government then Mr. Cain’s plan would set us on the right track,” Summer stated confidently.

Tom Funnell, a recent graduate from the University of Southern California, added that from his experiences, “the rich tend to understand taxes better because they are paying a large portion of their income. A little accountant joke is that college students are Democrats until they become rich, and Republicans when they have to pay taxes.”

In 2008, IRS revenue from individuals was roughly $1 trillion and 97 percent of that was from the top 50 percent earners.

What this boils down to is that roughly half of all Americans do not even contribute revenue to the United States. What is even more surprising is that more than 70 percent of revenue comes from the top 10 percent of income earners. This percentage to dollar ratio provides an explanation for why the rich get the biggest breaks on tax refunds.

“The House of Representatives would not let Obama’s proposal ever pass,” explained Funnell. “What it boils down to is that the parties are at polar ends from each other and unwilling to compromise. So any tax law passed will not create any reform, but may give way to small victories for each party that creates an amazingly complex tax system like we have today.”